Alright folks, let’s talk about something we all love to hate—taxes. But don’t worry, we’re here to make it less painful. If you’ve been hearing about the 1040 Tax Express and wondering what it’s all about, you’re in the right place. This isn’t just another boring tax article; it’s your go-to guide for understanding how the 1040 form works, why it matters, and how to file it like a pro. Let’s dive in!

Now, I know what you’re thinking—“taxes are complicated.” And yeah, they can be. But the 1040 Tax Express is designed to simplify things for you. It’s like a shortcut to filing your federal income tax return without losing your mind. Whether you’re a first-time filer or a seasoned taxpayer, this guide will help you navigate the process with ease.

Before we get into the nitty-gritty, let me assure you that this isn’t rocket science. Sure, there are some terms and rules to learn, but with the right tools and info, you’ll be filing your taxes like a champ in no time. So grab a coffee, sit back, and let’s break it down step by step. Your wallet—and peace of mind—will thank you later.

Read also:Elon Musks Controversial Rant Sparks Debate A Deep Dive Into The Tech Titans Explosive Remarks

What is 1040 Tax Express and Why Should You Care?

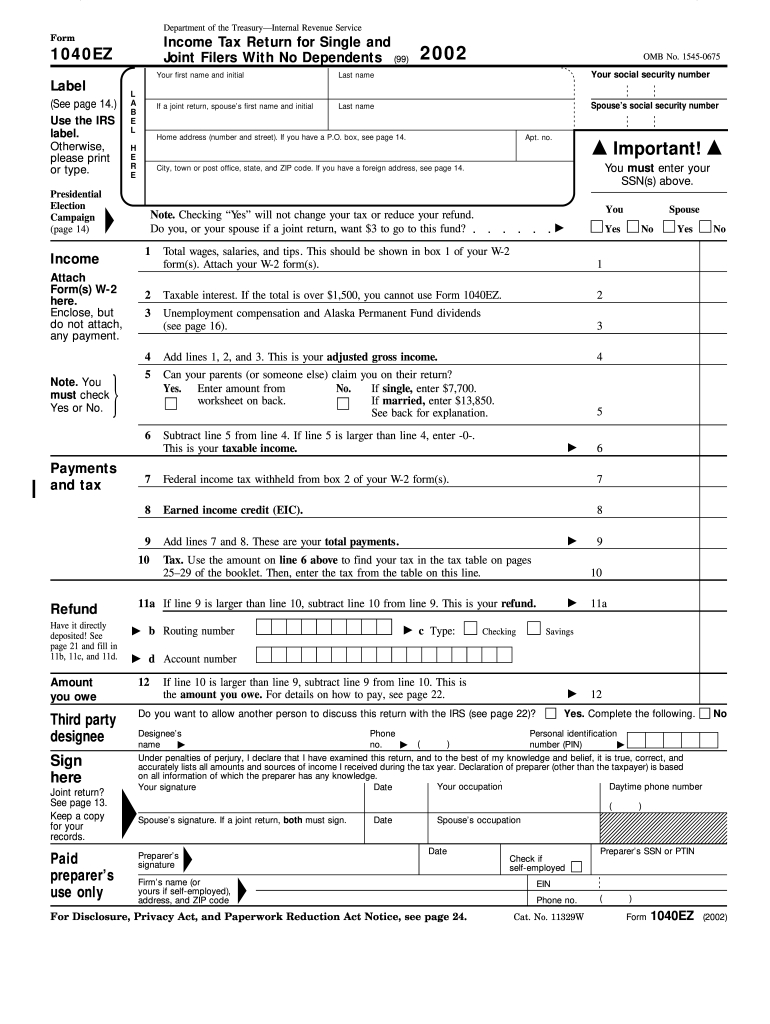

Let’s start with the basics. The 1040 Tax Express refers to the IRS Form 1040, which is the standard form used by individuals to file their federal income tax returns. It’s basically the form that determines how much tax you owe—or how much you’ll get back. If you earn money in the U.S., chances are you’ll need to fill out this form annually.

Here’s the deal: the 1040 form isn’t as scary as it sounds. In fact, it’s been simplified over the years to make life easier for taxpayers. The IRS introduced the “simpler” version of the 1040 form in 2018, eliminating some of the confusion and reducing the number of schedules you might need to file. This means less paperwork and more time for you to focus on other important things.

Key Benefits of Using 1040 Tax Express

Why should you care about the 1040 Tax Express? Well, here are a few reasons:

- It’s the primary form for filing your federal taxes, so you can’t avoid it.

- It helps you calculate your tax liability or refund accurately.

- It’s user-friendly and designed to save you time and effort.

- It ensures compliance with IRS regulations, keeping you out of trouble.

Think of the 1040 form as your personal assistant when it comes to taxes. It’s there to help you organize your financial info and ensure you’re paying the right amount. Plus, if you’re eligible for a tax refund, it’s the quickest way to get that money back in your pocket.

Understanding the Importance of 1040 Tax Express

Now, let’s talk about why the 1040 Tax Express is so important. First off, it’s the foundation of your tax filing process. Without it, you wouldn’t be able to report your income, claim deductions, or get your well-deserved refund. It’s like the backbone of your financial health when it comes to taxes.

But here’s the kicker: the 1040 form isn’t just about numbers. It’s also about fairness. By filing accurately, you’re contributing to the system that funds public services, infrastructure, and more. Plus, it helps you avoid penalties and interest charges if you happen to owe money to the IRS.

Read also:Yumi Eto Hospitalized The Inside Story You Need To Know

Who Needs to File the 1040 Form?

Not everyone needs to file a tax return, but most people do. Here’s a quick rundown of who should file the 1040 form:

- Individuals who earn above a certain income threshold.

- Self-employed individuals.

- Those who owe additional taxes, such as self-employment tax or alternative minimum tax.

- People who want to claim certain credits or deductions.

If you’re unsure whether you need to file, don’t worry. The IRS provides guidelines based on your filing status, age, and income level. Just do a quick check, and you’ll know for sure.

How to Use 1040 Tax Express: A Step-by-Step Guide

Filing your taxes with the 1040 Tax Express doesn’t have to be overwhelming. With the right approach, you can breeze through the process in no time. Here’s a step-by-step guide to help you get started:

Gather Your Documents

Before you dive into the 1040 form, make sure you have all the necessary documents ready. These typically include:

- W-2 forms from your employer(s).

- 1099 forms for freelance or investment income.

- Receipts for deductible expenses.

- Bank statements for any interest or dividend income.

Having everything organized upfront will save you a ton of time and hassle later on.

Fill Out the Form

Once you have your documents, it’s time to fill out the 1040 form. Start with your personal info, such as your name, Social Security number, and filing status. Then, move on to reporting your income, claiming deductions, and calculating your tax liability.

Don’t forget to double-check your work before submitting. A small mistake could delay your refund or lead to penalties. Trust me, nobody wants that.

Common Mistakes to Avoid When Filing with 1040 Tax Express

Even the best of us make mistakes when filing taxes. But with the 1040 Tax Express, you can minimize errors by being aware of the common pitfalls. Here are a few to watch out for:

- Incorrect Social Security number or name.

- Forgetting to report all sources of income.

- Miscalculating deductions or credits.

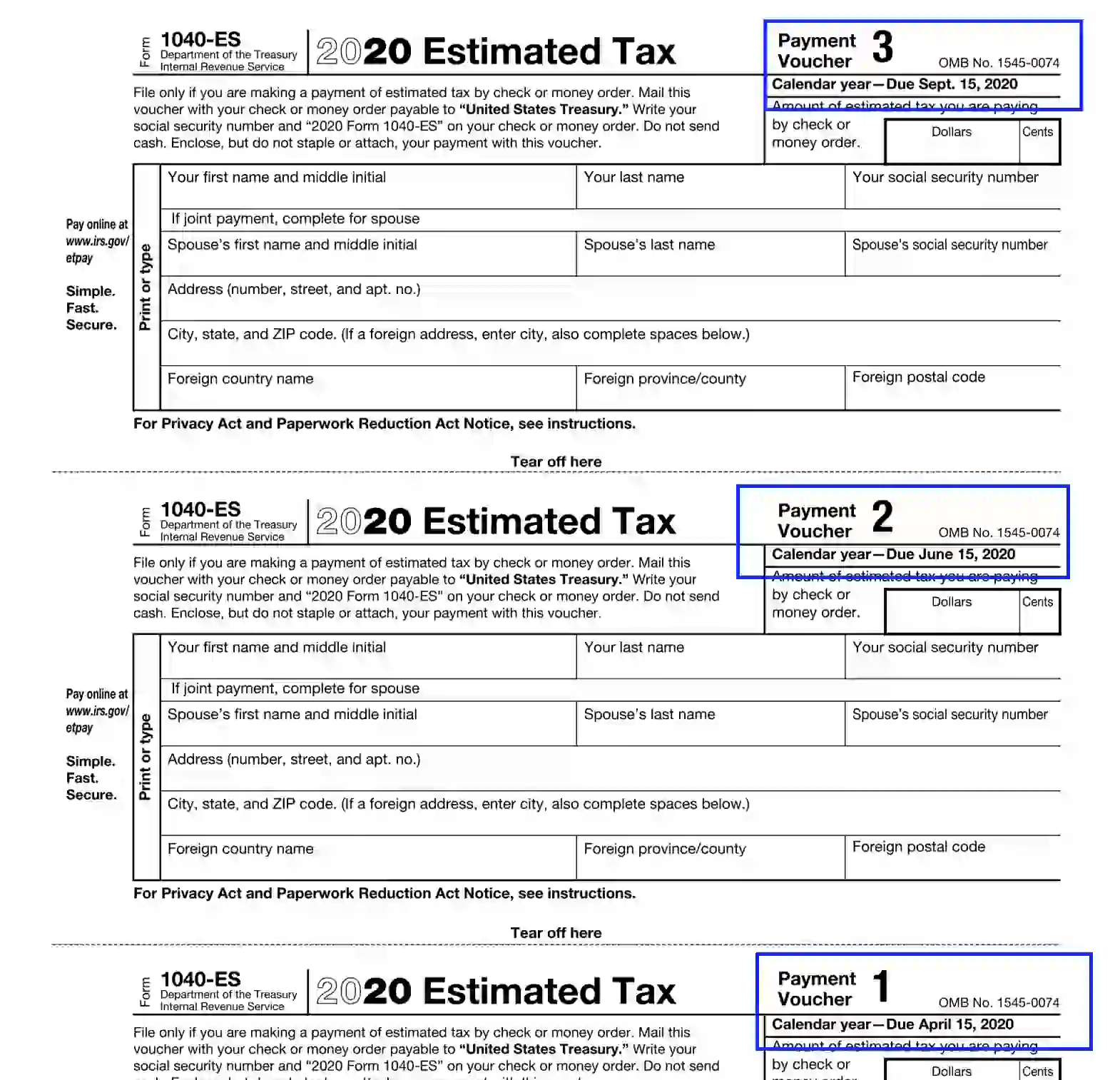

- Missing deadlines or failing to file on time.

Remember, attention to detail is key. Take your time, and if you’re unsure about anything, don’t hesitate to consult a tax professional or use tax software for assistance.

1040 Tax Express and Your Money: Maximizing Your Refund

Let’s be honest—everyone loves a good tax refund. And the 1040 Tax Express can help you maximize that refund by claiming the right deductions and credits. Here are a few tips to boost your chances:

Claim Standard or Itemized Deductions

One of the biggest decisions you’ll face is whether to claim the standard deduction or itemize your deductions. The standard deduction is a fixed amount based on your filing status, while itemizing allows you to deduct specific expenses. Do the math and see which option benefits you more.

Take Advantage of Tax Credits

Tax credits are like gold when it comes to reducing your tax bill. Some popular credits include:

- Child Tax Credit.

- Earned Income Tax Credit (EITC).

- American Opportunity Credit (for education expenses).

Make sure you qualify for these credits and claim them on your 1040 form. Every little bit helps!

1040 Tax Express and Technology: Making Life Easier

In today’s digital age, filing taxes has never been easier. Thanks to online tools and software, you can complete your 1040 Tax Express with minimal effort. Here are a few options to consider:

Tax Software

Platforms like TurboTax, H&R Block, and TaxSlayer offer user-friendly interfaces that guide you through the filing process. They also ensure accuracy and help you catch potential errors before submission.

e-File

Submitting your 1040 form electronically (e-filing) is faster and more secure than mailing a paper return. Plus, you’ll receive your refund much quicker if you choose direct deposit.

Embracing technology can save you time and reduce stress. Why not take advantage of the resources available to make your life easier?

1040 Tax Express: Tips for First-Time Filers

If you’re new to the world of taxes, don’t panic. Here are some tips specifically for first-time filers:

- Start early to avoid last-minute rush.

- Seek advice from a trusted tax professional if needed.

- Use free IRS resources or tax software to simplify the process.

- Keep copies of your filed returns for future reference.

Remember, filing taxes is a learning experience. The more you do it, the more comfortable you’ll become. So take it one step at a time and don’t be afraid to ask questions.

Conclusion: Take Control of Your Taxes with 1040 Tax Express

And there you have it, folks—a comprehensive guide to the 1040 Tax Express. Whether you’re a seasoned taxpayer or a first-timer, this form is your key to filing your federal taxes accurately and efficiently. By following the steps outlined in this article, you’ll be well on your way to mastering the process.

So, what’s next? Take action! Gather your documents, fill out the 1040 form, and submit your return before the deadline. And if you found this article helpful, don’t forget to share it with your friends and family. Knowledge is power, especially when it comes to taxes.

Table of Contents:

- What is 1040 Tax Express and Why Should You Care?

- Understanding the Importance of 1040 Tax Express

- How to Use 1040 Tax Express: A Step-by-Step Guide

- Common Mistakes to Avoid When Filing with 1040 Tax Express

- 1040 Tax Express and Your Money: Maximizing Your Refund

- 1040 Tax Express and Technology: Making Life Easier

- 1040 Tax Express: Tips for First-Time Filers

Happy filing, and may your tax season be as stress-free as possible!