Ever wondered how to navigate through QuestDiagnostics.com bill? If you're scratching your head over medical billing lingo or trying to figure out what’s covered and what’s not, you’re not alone. Medical bills can feel like a maze, but don’t worry—we’ve got your back. In this article, we’ll break down everything you need to know about QuestDiagnostics.com billing, so you can manage your finances with confidence.

Let’s face it, medical bills are one of those things no one really looks forward to. But when you’re dealing with a big-name diagnostics company like Quest Diagnostics, you want to make sure every penny you spend is justified. Whether it’s a routine blood test or a more complex procedure, understanding your bill is the first step toward financial clarity.

From decoding those cryptic codes to disputing charges you don’t recognize, this article is your ultimate guide. So grab a cup of coffee, sit back, and let’s dive into the world of QuestDiagnostics.com billing together. Your wallet will thank you later.

Read also:Barkley Gets Booed For Homeless Comment The Real Story Behind The Backlash

What is QuestDiagnostics.com Bill?

Alright, let’s start with the basics. QuestDiagnostics.com bill refers to the financial statement you receive after undergoing diagnostic tests or procedures through Quest Diagnostics. Think of it as a detailed breakdown of the services provided, the charges associated with them, and any insurance adjustments that may apply. It’s like a receipt for your health, but way more complicated.

Quest Diagnostics is one of the largest diagnostic testing companies in the U.S., performing millions of tests each year. When you visit a healthcare provider, they often partner with Quest to run tests like blood work, imaging, and more. Once the tests are complete, you’ll receive a bill outlining the costs involved.

Here’s the kicker: medical bills aren’t just about the tests themselves. They also include administrative fees, lab charges, and sometimes even additional costs for specialized equipment. Understanding these components is key to avoiding unexpected expenses.

Why Understanding Your Bill Matters

Medical bills aren’t just numbers on a page—they’re a reflection of your healthcare journey. If you don’t understand your QuestDiagnostics.com bill, you might end up paying for services you didn’t receive or overpaying due to billing errors. Did you know that up to 80% of medical bills contain errors? Yikes!

Here’s a quick list of why understanding your bill is so important:

- Avoid unnecessary charges

- Ensure your insurance is applied correctly

- Prevent surprise bills

- Protect your credit score

- Empower yourself to negotiate if needed

By taking the time to review your bill carefully, you can save yourself from financial headaches down the road. Plus, who doesn’t love saving money?

Read also:Michael Boulos Religion Muslim Unveiling The Truth Behind The Faith

How QuestDiagnostics.com Billing Works

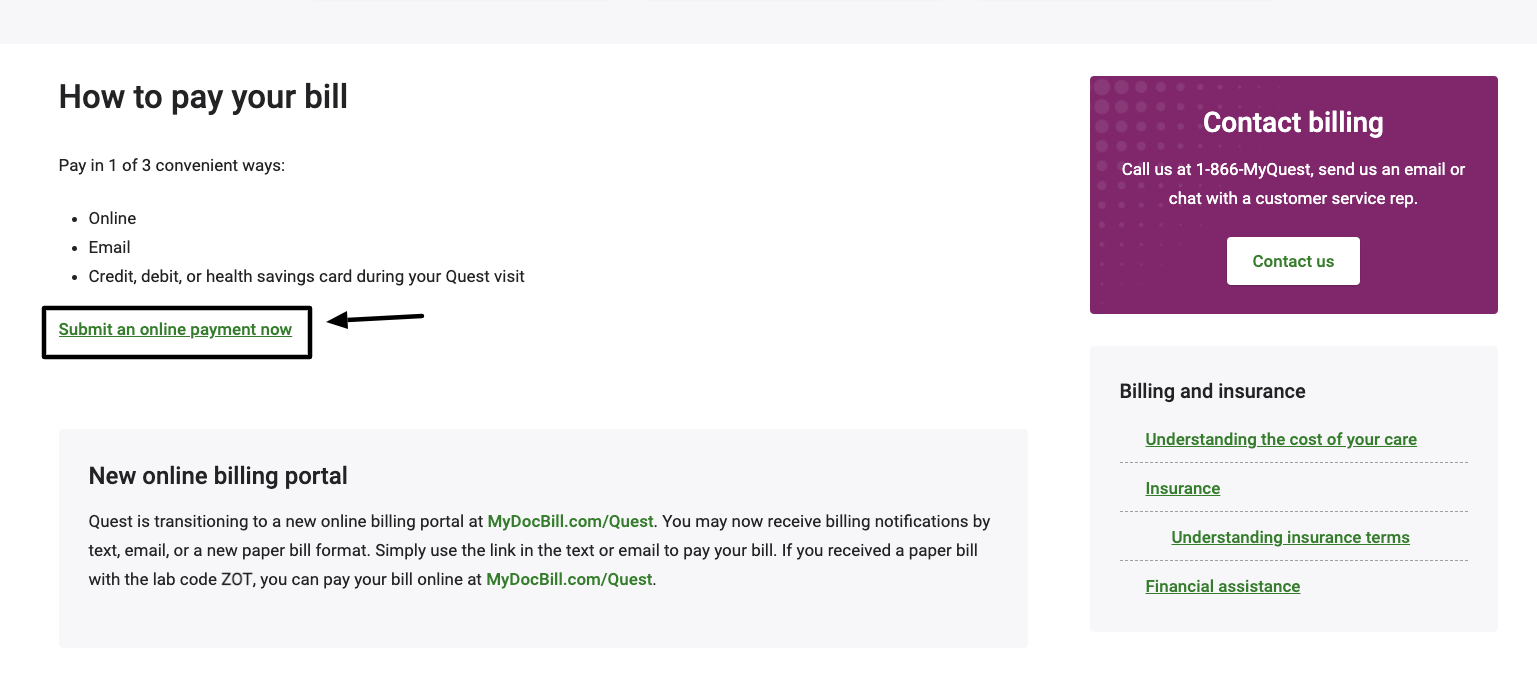

QuestDiagnostics.com billing follows a pretty standard process, but there are a few twists that you should be aware of. Here’s a step-by-step breakdown of how it all works:

- Service Provided: You undergo a diagnostic test or procedure at a Quest facility or through a partnered healthcare provider.

- Claim Submission: Quest submits the bill to your insurance company (if applicable).

- Insurance Adjustment: Your insurance provider reviews the claim and determines how much they’ll cover.

- Balance Due: Any remaining balance after insurance is applied becomes your responsibility.

- Bill Delivery: Quest sends you the final bill, detailing the charges and any adjustments made.

Simple, right? Well, not exactly. Medical billing can get pretty convoluted, especially if you’re dealing with multiple providers or complex procedures. That’s why it’s crucial to stay on top of things.

Common Components of a QuestDiagnostics.com Bill

When you open your QuestDiagnostics.com bill, you’ll notice several key components. Let’s break them down:

- Procedure Codes: These are alphanumeric codes that describe the specific tests or procedures performed. For example, a blood glucose test might have a code like 82947.

- Charges: The total cost of the service before any insurance adjustments.

- Insurance Payment: The amount your insurance provider has covered.

- Patient Responsibility: The remaining balance you owe, including co-pays, deductibles, and coinsurance.

- Notes: Any additional information about the bill, such as payment deadlines or dispute instructions.

Pro tip: Always double-check the procedure codes to ensure they match the services you received. Mistakes happen more often than you’d think!

Decoding Your QuestDiagnostics.com Bill

Now that you know what to expect, let’s dive into the nitty-gritty of decoding your bill. Here are some tips to help you navigate the process:

1. Check for Errors

Medical billing errors are surprisingly common. Look out for:

- Charges for services you didn’t receive

- Incorrect procedure codes

- Duplicate charges

- Overcharged amounts

If you spot anything fishy, don’t hesitate to reach out to Quest Diagnostics or your insurance provider for clarification.

2. Verify Insurance Coverage

Make sure your insurance has been applied correctly. If you believe a service should have been covered but wasn’t, contact your insurer to discuss the matter.

3. Understand Your Deductible

Your deductible is the amount you must pay out-of-pocket before your insurance kicks in. Knowing your deductible can help you anticipate your costs and plan accordingly.

Common Questions About QuestDiagnostics.com Billing

Still have questions? You’re not alone. Here are some frequently asked questions about QuestDiagnostics.com bills:

- How long does it take to receive a bill? Typically, you’ll receive your bill within 30 days of the service date.

- What if I can’t pay the full amount? Quest offers payment plans and financial assistance options for eligible patients.

- Can I dispute a charge? Absolutely! If you believe a charge is incorrect, contact Quest’s customer service team to file a dispute.

Remember, you have rights as a patient. Don’t be afraid to advocate for yourself!

Tips for Managing Your Medical Expenses

Medical bills can be stressful, but there are ways to manage them effectively. Here are some practical tips:

1. Review Your Bill Thoroughly

Take the time to review every line item on your bill. If something doesn’t make sense, ask for clarification. Knowledge is power!

2. Negotiate When Possible

If you’re struggling to pay, don’t be afraid to negotiate. Many healthcare providers, including Quest Diagnostics, are willing to work with patients to find a solution.

3. Stay Organized

Keep all your billing documents in one place. This will make it easier to track payments, file disputes, and communicate with providers.

Financial Assistance Programs

Quest Diagnostics offers several financial assistance programs to help patients in need. Eligibility depends on factors like income, family size, and medical necessity. If you’re struggling to pay your bill, consider applying for assistance.

To apply, visit QuestDiagnostics.com and follow the instructions provided. Be prepared to provide proof of income and other relevant documents.

Conclusion: Take Control of Your Medical Bills

Managing your QuestDiagnostics.com bill doesn’t have to be a daunting task. By understanding how billing works, reviewing your bill carefully, and taking advantage of available resources, you can take control of your medical expenses.

Here’s a quick recap of what we’ve covered:

- QuestDiagnostics.com bills include detailed breakdowns of services, charges, and insurance adjustments.

- Medical billing errors are common, so always double-check your bill for accuracy.

- Financial assistance programs and payment plans are available for eligible patients.

Now it’s your turn! If you’ve found this article helpful, share it with friends or family who might benefit. And don’t forget to leave a comment below with your thoughts or questions. Together, we can make navigating medical bills a little less stressful.

Disclaimer: The information provided in this article is for educational purposes only. Always consult with a healthcare professional or financial advisor for personalized advice.

References

For further reading, check out these trusted sources:

Table of Contents