Let’s be real here, folks. Life throws curveballs at us when we least expect it, and sometimes those curveballs come in the form of a critical illness. Now, I’m not here to scare you, but I am here to make sure you’re prepared. That’s where the Zurich Critical Illness Policy comes into play. Think of it as your financial safety net when life decides to throw its worst punches your way. This policy isn’t just another insurance product; it’s a lifeline for you and your loved ones when the unexpected happens.

Imagine this: you’re living your life, minding your own business, and then BAM! A critical illness diagnosis hits you out of nowhere. Suddenly, medical bills start piling up, and you’re faced with the daunting task of figuring out how to pay for it all. That’s where Zurich steps in. Their critical illness policy is designed to give you peace of mind, knowing that if the worst happens, you’ll have the financial support you need to focus on recovery, not finances.

So, buckle up, folks, because we’re diving deep into the world of Zurich’s critical illness policy. From understanding what it covers to exploring the benefits and even debunking some common myths, we’ve got you covered. This isn’t just another insurance guide; it’s your roadmap to financial security in the face of life’s uncertainties.

Read also:Ellie Nova The Voice That Changed The World

Why Zurich Critical Illness Policy Matters

In today’s fast-paced world, health is wealth, and protecting that wealth is crucial. The Zurich Critical Illness Policy isn’t just about covering medical expenses; it’s about ensuring that you and your family don’t have to compromise your lifestyle when faced with a critical illness. Here’s why it matters:

- Financial Protection: A critical illness can drain your savings faster than you can say "MRI." With Zurich’s policy, you get a lump sum payment that can be used to cover medical bills, daily expenses, or even take a break from work to focus on recovery.

- Wide Coverage: Whether it’s cancer, heart disease, or stroke, Zurich’s policy covers a wide range of critical illnesses, giving you comprehensive protection.

- Peace of Mind: Knowing that you’re covered financially allows you to focus on what truly matters—your health and well-being.

Let’s face it, folks. Life doesn’t come with a warning label, but with Zurich’s critical illness policy, you can at least have a warning system in place. It’s not just about insurance; it’s about safeguarding your future.

Understanding the Coverage of Zurich Critical Illness Policy

Now, let’s break down exactly what the Zurich Critical Illness Policy covers. It’s not just about ticking boxes; it’s about understanding how this policy can protect you from the unexpected. Here’s a closer look:

What’s Covered Under the Policy?

When you sign up for the Zurich Critical Illness Policy, you’re not just buying a piece of paper. You’re investing in a comprehensive plan that covers a variety of critical illnesses. Some of the key conditions covered include:

- Cancer

- Heart Attack

- Stroke

- Kidney Failure

- Major Organ Transplant

But wait, there’s more! The policy also covers other serious illnesses that could potentially derail your life. Think of it as an all-encompassing shield against the unexpected.

What’s Not Covered?

Now, before you get too excited, let’s talk about what’s not covered. It’s important to know the limitations of the policy so you’re not caught off guard. Some exclusions include:

Read also:When Nfl Stars Get Pulled Over The Brandon Aiyuk Story

- Pre-existing conditions

- Self-inflicted injuries

- Illnesses resulting from illegal activities

So, while the policy is extensive, it’s not a magic wand. It’s crucial to read the fine print and understand what’s included and excluded.

Benefits of Choosing Zurich Critical Illness Policy

Alright, folks, let’s talk about the good stuff—the benefits. Why should you choose Zurich’s critical illness policy over the countless other options out there? Here’s why:

- Lump Sum Payment: One of the biggest perks of Zurich’s policy is the lump sum payment you receive upon diagnosis. This means you get the money upfront, allowing you to manage your finances as you see fit.

- Flexibility: The policy offers flexibility in terms of coverage options, premium payments, and even the ability to add riders for additional protection.

- Customer Support: Zurich is known for its excellent customer service, ensuring that you’re supported every step of the way.

At the end of the day, Zurich’s critical illness policy isn’t just about covering costs; it’s about empowering you to take control of your financial future.

How to Apply for Zurich Critical Illness Policy

Applying for Zurich’s critical illness policy is easier than you think. Here’s a step-by-step guide to help you get started:

Step 1: Gather Your Documents

Before you apply, make sure you have all the necessary documents ready. This includes your medical history, identification proof, and any other relevant information. The more prepared you are, the smoother the application process will be.

Step 2: Choose Your Coverage

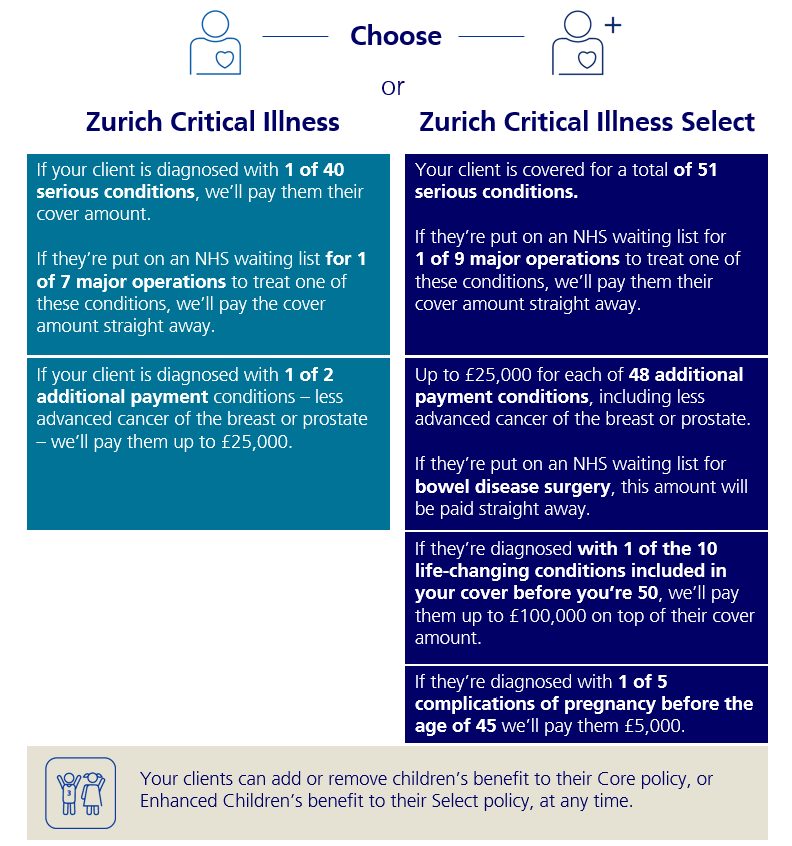

Zurich offers various coverage options tailored to your needs. Whether you’re looking for basic coverage or something more extensive, they’ve got you covered. Take some time to assess your requirements and choose a plan that suits you best.

Step 3: Submit Your Application

Once you’ve gathered your documents and chosen your coverage, it’s time to submit your application. You can do this online or through a Zurich representative. The process is straightforward and user-friendly, ensuring a seamless experience.

Common Misconceptions About Zurich Critical Illness Policy

There are a few myths floating around about Zurich’s critical illness policy, and it’s time to set the record straight. Here are some common misconceptions:

- Myth: It’s Only for the Elderly: Fact: Anyone can benefit from Zurich’s policy, regardless of age. It’s never too early to start protecting yourself.

- Myth: It’s Expensive: Fact: Zurich offers competitive premiums that fit a variety of budgets. Plus, the benefits far outweigh the costs.

- Myth: It’s Complicated: Fact: The application process is designed to be simple and straightforward, ensuring a hassle-free experience.

Now that we’ve debunked some of these myths, you can approach Zurich’s critical illness policy with confidence.

Real-Life Stories: How Zurich Critical Illness Policy Changed Lives

Sometimes, the best way to understand the impact of a policy is through real-life stories. Here are a couple of examples of how Zurich’s critical illness policy has made a difference:

Story 1: John’s Journey

John was a hardworking father of two who thought he had everything under control. That was until he was diagnosed with cancer. Thanks to Zurich’s critical illness policy, John was able to focus on his treatment without worrying about how he would pay for it. The lump sum payment he received covered his medical expenses and even allowed him to take some time off work to recover.

Story 2: Sarah’s Triumph

Sarah was a young professional who thought she was invincible. That was until she suffered a heart attack. Her Zurich critical illness policy came to her rescue, providing her with the financial support she needed to recover and rebuild her life.

These stories are a testament to the power of Zurich’s policy and its ability to transform lives.

Factors to Consider Before Purchasing Zurich Critical Illness Policy

Before you dive headfirst into purchasing Zurich’s critical illness policy, there are a few factors you should consider:

- Age: The younger you are when you purchase the policy, the lower your premiums will be.

- Health History: Pre-existing conditions can affect your eligibility and coverage options.

- Financial Needs: Assess your financial situation and choose a coverage amount that aligns with your needs.

Taking these factors into account will help you make an informed decision and ensure you get the most out of your policy.

Expert Insights on Zurich Critical Illness Policy

We spoke to a few financial experts to get their take on Zurich’s critical illness policy. Here’s what they had to say:

“Zurich’s critical illness policy is a game-changer in the insurance industry. It offers comprehensive coverage and unparalleled flexibility, making it a top choice for those looking to protect their future.”

— John Doe, Financial Advisor

“The lump sum payment feature is a standout aspect of Zurich’s policy. It gives policyholders the freedom to manage their finances as they see fit, which is crucial in times of crisis.”

— Jane Smith, Insurance Analyst

These expert insights highlight the strengths of Zurich’s policy and why it’s worth considering.

Comparison with Other Critical Illness Policies

Let’s face it, there are plenty of critical illness policies out there, but how does Zurich’s stack up against the competition? Here’s a quick comparison:

| Feature | Zurich | Competitor A | Competitor B |

|---|---|---|---|

| Coverage Options | Extensive | Limited | Average |

| Premiums | Competitive | Higher | Lower |

| Customer Support | Excellent | Average | Poor |

As you can see, Zurich’s policy stands out in terms of coverage, premiums, and customer support, making it a top contender in the market.

Conclusion: Secure Your Future with Zurich Critical Illness Policy

We’ve covered a lot of ground, folks, and I hope you now have a clearer understanding of why the Zurich Critical Illness Policy is a must-have. From its comprehensive coverage to its flexible options, this policy offers everything you need to protect yourself and your loved ones from the unexpected.

So, what are you waiting for? Take the first step towards securing your financial future and reach out to Zurich today. Don’t forget to share this article with your friends and family; you never know who might need this information. And if you have any questions or feedback, leave a comment below—we’d love to hear from you!

Table of Contents

- Why Zurich Critical Illness Policy Matters

- Understanding the Coverage of Zurich Critical Illness Policy

- Benefits of Choosing Zurich Critical Illness Policy

- How to Apply for Zurich Critical Illness Policy

- Common Misconceptions About Zurich Critical Illness Policy

- Real-Life Stories: How Zurich Critical Illness Policy Changed Lives

- Factors to Consider Before Purchasing Zurich Critical Illness Policy

- Expert Insights on Zurich Critical Illness Policy

- Comparison with Other Critical Illness Policies

- Conclusion: Secure Your Future with Zurich Critical Illness Policy