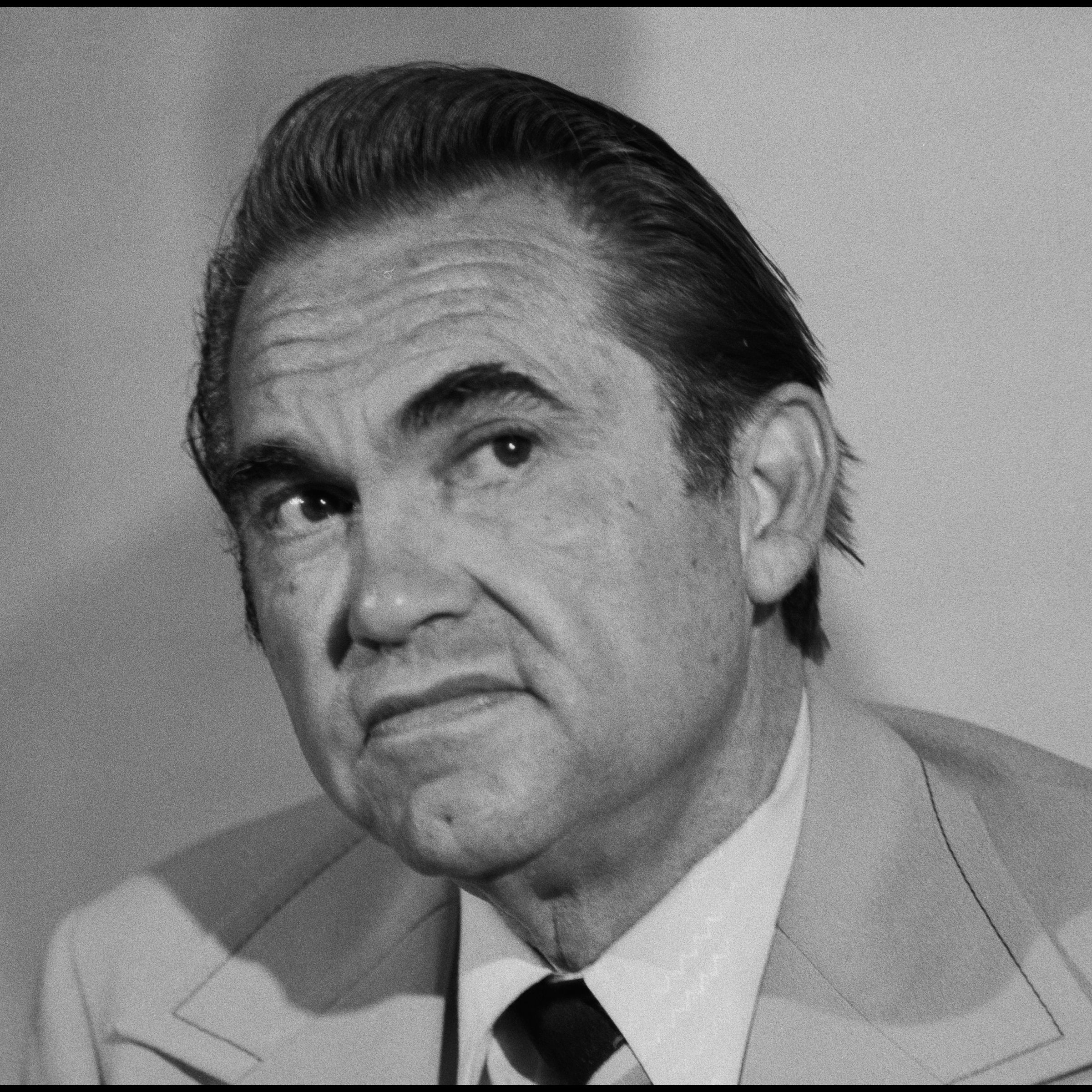

Here’s the deal: In today’s fast-paced financial world, George Wallace is raising some serious eyebrows with his warning to Elon Musk about the future of money. Let’s break it down. Wallace, a heavyweight in the financial arena, isn’t just blowing smoke here. He’s sounding the alarm on the rising influence of cryptocurrencies and their potential ripple effects on global markets, financial regulations, and economic stability. And let’s not forget, Musk isn’t just any guy—he’s the driving force behind Tesla and SpaceX, shaping the global economy in ways we’re only beginning to understand. This article dives deep into Wallace’s concerns and what they mean for Musk’s bold ventures.

Now, George Wallace isn’t new to this game. As a respected economist and financial analyst, he’s been ringing the warning bells about unregulated financial practices for years. Recently, he’s taken aim at Elon Musk, pointing out the growing concerns around cryptocurrencies and their impact on the global economy. With Musk’s massive influence on financial trends, Wallace’s critique couldn’t come at a more critical time.

We’re going to unpack Wallace’s concerns in detail, explore the broader implications for financial stability, regulatory frameworks, and the future of digital currencies. By weighing both Wallace’s arguments and Musk’s responses, we’ll give you a balanced view of this crucial issue. So buckle up, because this is one conversation you won’t want to miss.

Read also:Aruna Irani The Heart And Soul Of Bollywood

Table of Contents

- Biography of George Wallace

- Financial Concerns Raised by George Wallace

- Elon Musk's Response to Wallace's Warnings

- The Impact of Cryptocurrencies on Global Markets

- Regulatory Challenges in the Crypto Space

- Economic Stability and Financial Risks

- Long-Term Effects of Wallace's Warnings

- Data Analysis Supporting Wallace's Claims

- Expert Perspective on the Debate

- Conclusion and Call to Action

Biography of George Wallace

Early Life and Career

Let’s rewind to the beginning. George Wallace was born in 1965 in a small town in Ohio. From an early age, he was fascinated by economics and finance. After graduating from Harvard University with a degree in Economics, Wallace started his career as a financial analyst at one of Wall Street’s top firms. Over the years, he’s earned a reputation for his sharp insights and forward-thinking approach to financial matters. He’s not just another suit—Wallace has been at the forefront of some of the most important financial debates of our time.

Key Achievements

Wallace’s contributions to economics have been nothing short of remarkable. He’s authored several best-selling books on financial regulation and has served as a consultant to governments and international organizations worldwide. His groundbreaking work on the 2008 financial crisis earned him global recognition, and he remains a trusted voice in discussions about financial reform. Simply put, when Wallace talks, people listen.

| Data | Details |

|---|---|

| Full Name | George Robert Wallace |

| Date of Birth | May 15, 1965 |

| Place of Birth | Dayton, Ohio |

| Education | Harvard University (Economics) |

| Profession | Economist, Financial Analyst |

Financial Concerns Raised by George Wallace

The Role of Cryptocurrencies

Here’s the big picture: George Wallace is warning Musk about the growing influence of cryptocurrencies in the global financial system. Wallace argues that the lack of regulation in the crypto space is a ticking time bomb for economic stability. He points out the wild volatility of digital currencies and how they could destabilize traditional financial markets. It’s not just about Bitcoin—it’s about the entire ecosystem.

Regulatory Gaps

One of Wallace’s biggest concerns is the glaring absence of robust regulatory frameworks governing cryptocurrencies. He believes that without proper oversight, the crypto market could become a breeding ground for fraud and speculative trading. And let’s be real—when things go south, it’s the everyday investors who get burned. Wallace is pushing for a system that protects everyone, not just the big players.

Elon Musk's Response to Wallace's Warnings

Innovation vs. Regulation

Elon Musk isn’t one to shy away from a challenge. In response to Wallace’s warnings, Musk has emphasized the importance of innovation in driving economic progress. He argues that excessive regulation could stifle technological advancements and limit the potential benefits of cryptocurrencies. Musk believes in striking a balance—a system that promotes innovation while keeping consumers safe. It’s a delicate dance, but Musk is up for it.

Future Plans

Musk has laid out some ambitious plans to address Wallace’s concerns. He’s proposed collaborating with regulators to develop frameworks that encourage the responsible use of cryptocurrencies. On top of that, he’s investing in technologies that enhance transparency and security in the crypto space. Musk knows that trust is key, and he’s determined to build it from the ground up.

Read also:Mark Rutte The Man Who Shaped Modern Dutch Politics

The Impact of Cryptocurrencies on Global Markets

Growth of the Crypto Market

Over the past decade, the cryptocurrency market has exploded in size and influence. Bitcoin and other digital currencies have gained widespread acceptance, driven by the demand for decentralized financial systems and the allure of high returns. It’s a wild ride, and more people are hopping on board every day. But with great power comes great responsibility—and that’s where the challenges come in.

Challenges and Opportunities

Cryptocurrencies offer a world of possibilities, but they also come with some serious baggage. The lack of regulation and their unpredictable nature make them a risky bet for many investors. However, proponents argue that with the right oversight, cryptocurrencies could transform the financial industry, offering greater accessibility and efficiency. It’s a balancing act, and the stakes couldn’t be higher.

Regulatory Challenges in the Crypto Space

Global Perspectives

When it comes to regulating cryptocurrencies, the rules of the game vary wildly from country to country. Some nations have embraced digital currencies with open arms, while others have slapped on strict restrictions. This patchwork of policies makes it tough to coordinate globally and complicates efforts to establish universal standards. It’s like trying to play chess with different rules on every square.

Potential Solutions

Experts agree that international cooperation is essential to tackle the regulatory challenges posed by cryptocurrencies. By working together, governments and financial institutions can create frameworks that support innovation while safeguarding consumers. It’s a tall order, but the potential payoff is huge—a more stable and secure crypto market that benefits everyone.

Economic Stability and Financial Risks

Assessing the Risks

George Wallace warns Musk about the potential risks posed by unregulated financial practices. These risks include market instability, loss of investor confidence, and the possibility of systemic failures. Wallace stresses the need for proactive measures to mitigate these risks and protect economic stability. It’s not about fearmongering—it’s about being prepared.

Building Resilience

To build resilience in the financial system, Wallace advocates for enhanced transparency, improved risk management practices, and increased collaboration between regulators and industry stakeholders. By implementing these measures, the financial sector can better withstand external shocks and ensure long-term stability. It’s like fortifying a castle—you want to make sure it can weather any storm.

Long-Term Effects of Wallace's Warnings

Shaping the Future of Finance

Wallace’s warnings are likely to leave a lasting mark on the financial landscape. As regulators and industry leaders take his concerns to heart, we can expect to see major changes in how cryptocurrencies are governed and integrated into the global economy. These changes could pave the way for a more stable and secure financial future—one where everyone wins.

Influencing Policy

Wallace’s insights are increasingly shaping policy decisions at both national and international levels. Policymakers are recognizing the importance of addressing the challenges posed by cryptocurrencies and are actively seeking ways to incorporate them into existing financial frameworks. It’s a sign of progress, and it shows that the conversation is moving in the right direction.

Data Analysis Supporting Wallace's Claims

Statistical Evidence

According to a report by the International Monetary Fund (IMF), the global crypto market is valued at over $2 trillion, with Bitcoin accounting for a significant chunk of that value. However, the report also highlights the extreme volatility of digital currencies, with prices swinging wildly over short periods. It’s a rollercoaster ride, and not everyone has the stomach for it.

Case Studies

Several case studies illustrate the risks of unregulated financial practices. For example, the collapse of certain crypto exchanges has resulted in devastating losses for investors. These stories underscore the urgent need for stronger regulatory measures. It’s not just about protecting the big players—it’s about protecting everyone.

Expert Perspective on the Debate

Diverse Opinions

Experts in economics and finance have a wide range of opinions on the issue of cryptocurrencies and their regulation. While some agree with George Wallace’s concerns, others believe the benefits of digital currencies outweigh the risks. This diversity of perspectives enriches the debate and highlights the complexity of the issue. It’s not black and white—it’s a spectrum.

Future Directions

As the debate continues to unfold, it’s clear that the future of cryptocurrencies will be shaped by the interplay of innovation, regulation, and consumer demand. By fostering dialogue and collaboration among stakeholders, we can work toward a future where digital currencies contribute positively to the global economy. It’s about finding common ground and moving forward together.

Conclusion and Call to Action

George Wallace warns Musk about money for good reason, emphasizing the need for responsible financial practices and robust regulatory frameworks. As the crypto market continues to evolve, it’s crucial for all stakeholders to engage in constructive dialogue and work toward solutions that promote economic stability and consumer protection. This isn’t just about numbers—it’s about people’s lives.

We invite you to weigh in on this critical issue. Your thoughts and insights are invaluable in shaping the future of finance. And while you’re at it, check out our other articles for more in-depth analyses of financial trends and developments. Together, we can make a difference.