Building a house is one of the most significant investments you’ll ever make in life and getting your budget right from the start is crucial like seriously crucial. A well-planned budget can turn your dream home into a reality without leaving you broke or stressed out. So let’s dive deep into everything you need to know about creating a solid house construction budget. Whether you’re a first-time builder or an experienced homeowner looking to expand your property this guide has got you covered.

Before we get into the nitty-gritty details of budgeting for your dream house it’s important to understand that a construction budget isn’t just a simple list of numbers. It’s a roadmap that outlines every expense from permits to furniture. Think of it as a blueprint for your finances ensuring that every dollar is spent wisely. And trust me when I say this a little extra effort in planning can save you thousands down the road.

Now let’s be real here building a house can feel overwhelming at first especially if you’re not familiar with the ins and outs of construction costs. But don’t worry we’ve got your back. This article will walk you through every step of creating a house construction budget so you can approach the project with confidence and clarity. Ready to get started? Let’s go!

Read also:Candice Bergen The Iconic Star Who Changed Tv And Journalism Forever

Table of Contents:

- Understanding Your House Construction Budget

- Key Components of a Construction Budget

- Step-by-Step Guide to Creating Your Budget

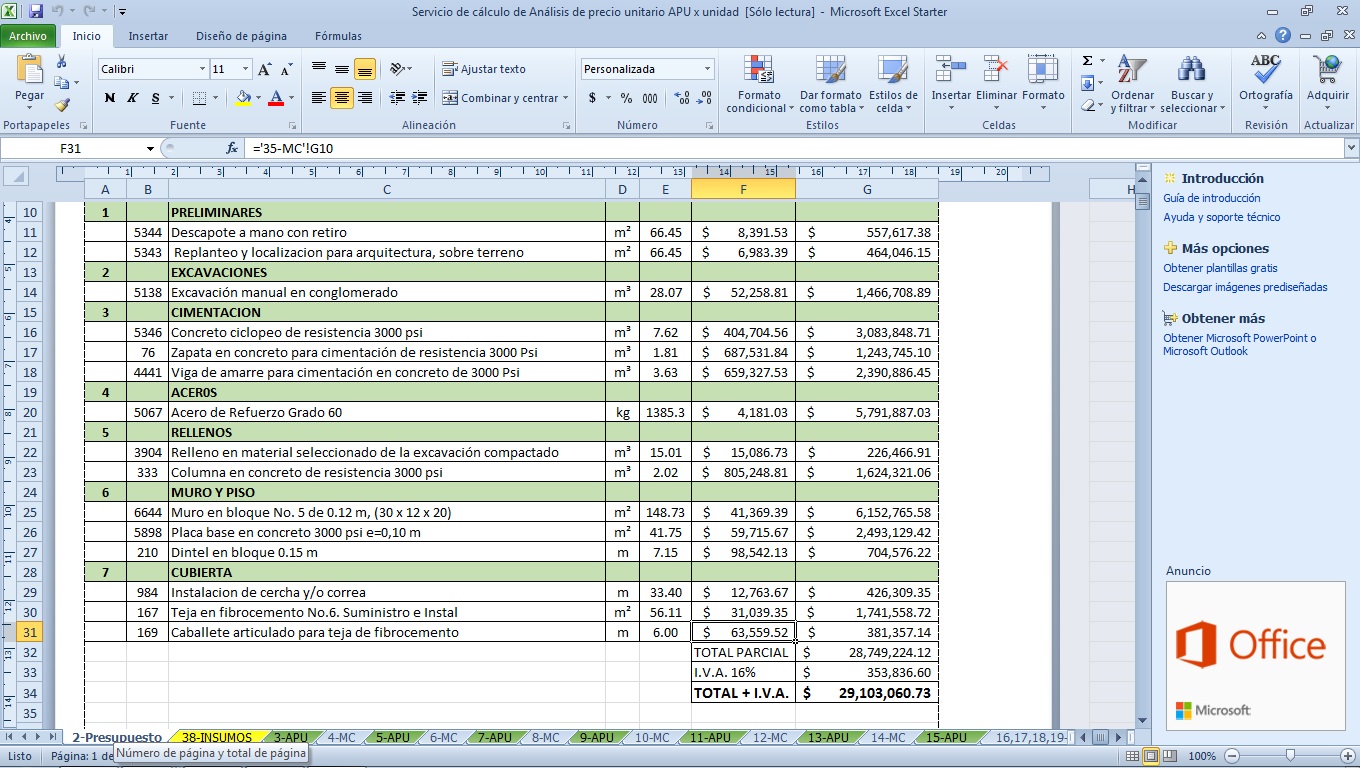

- Detailed Cost Breakdown for Building a House

- Uncovering Hidden Costs in Construction

- Financing Options for Your Dream Home

- Practical Tips for Staying Within Budget

- Common Mistakes to Avoid When Budgeting

- Useful Tools for Managing Your Construction Budget

- Final Thoughts and Next Steps

Understanding Your House Construction Budget

Alright let’s start with the basics. What exactly is a house construction budget? Simply put it’s a financial plan that outlines all the costs associated with building your home. But it’s not just about adding up numbers it’s about prioritizing expenses managing risks and ensuring that your dream home doesn’t become a financial nightmare.

One of the biggest misconceptions people have is thinking that the cost of materials and labor is all they need to worry about. Spoiler alert there’s way more to it than that. From permits and inspections to landscaping and furniture your budget needs to account for everything. And guess what? Unexpected expenses are pretty much guaranteed so you better have a contingency plan in place.

Why Planning Matters

Planning your budget early on can make a world of difference. It helps you avoid costly mistakes identify potential issues and keep your project on track. Think of it this way would you go on a road trip without checking your car’s oil or fuel? Probably not right? The same logic applies here. A well-thought-out budget is your safety net ensuring that you don’t run out of funds midway through the project.

Key Components of a Construction Budget

Now let’s break down the main components of a construction budget. These are the essential categories you need to consider when planning your house build. And trust me this isn’t just a random list these are the real deal based on industry standards and expert advice.

- Land Acquisition: The cost of purchasing the land where you’ll build your house. Don’t forget to factor in any additional expenses like clearing or leveling the land.

- Permits and Fees: Building permits inspections and other regulatory costs. These can vary depending on your location so do your research.

- Foundation and Structure: This includes excavation footings walls and roofing. It’s one of the largest portions of your budget so plan accordingly.

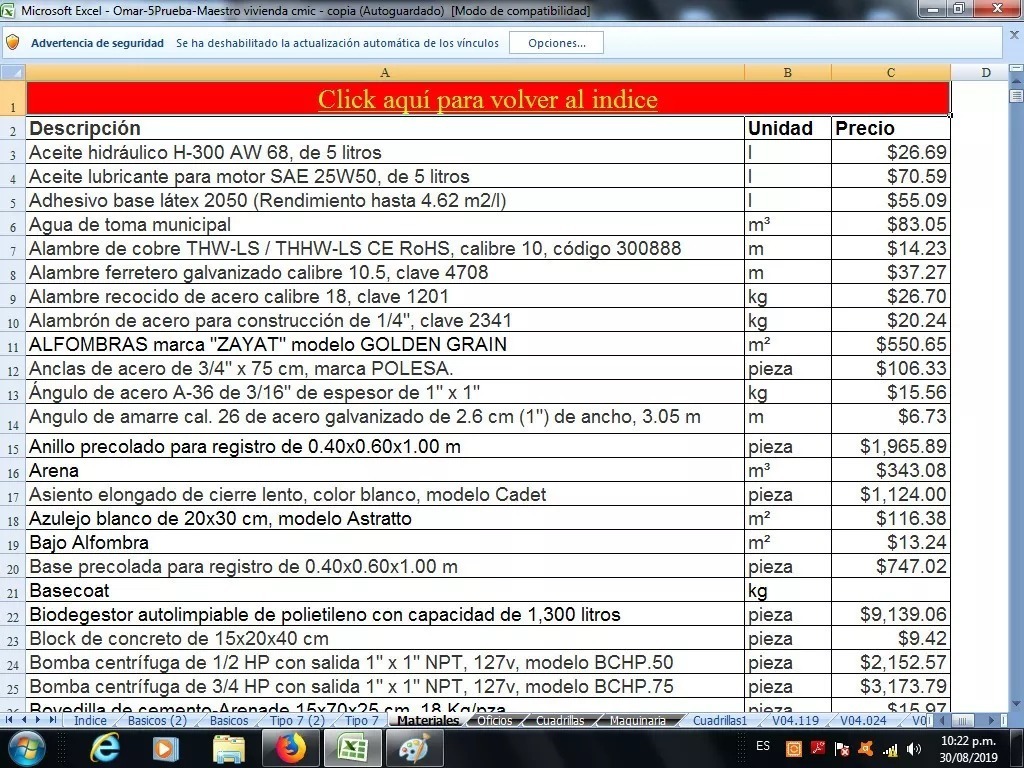

- Materials: Everything from lumber and concrete to windows and doors. Quality matters here so don’t skimp on essential materials.

- Finishes: Flooring cabinetry paint and fixtures. This is where your personal style comes into play but it can also add up quickly.

- Utilities: Plumbing electrical and HVAC systems. These are critical for making your home livable so make sure they’re done right.

- Landscaping: Outdoor spaces gardens and driveways. Don’t forget the exterior of your home it’s the first thing people see.

- Contingency Fund: A buffer for unexpected expenses. Experts recommend setting aside 10-20% of your total budget for this purpose.

Step-by-Step Guide to Creating Your Budget

Creating a construction budget might sound intimidating but it doesn’t have to be. Follow these steps and you’ll be well on your way to building a solid financial plan for your dream home.

Read also:Grambling Basketball A Legacy Of Passion Talent And Triumph

Step 1: Define Your Goals

Start by defining what you want your home to look like. Are you building a small cozy cottage or a large family home? Knowing your priorities will help you allocate funds more effectively.

Step 2: Research Costs

Do your homework. Get quotes from contractors visit showrooms and talk to other homeowners who’ve recently built. The more information you gather the better prepared you’ll be.

Step 3: Set a Budget

Based on your research set a realistic budget. Be honest with yourself about how much you can afford to spend. Remember it’s better to under-promise and over-deliver than the other way around.

Step 4: Prioritize Expenses

Not all expenses are created equal. Decide which features are must-haves and which ones can be postponed or adjusted if needed. This will help you stay flexible without compromising on quality.

Detailed Cost Breakdown for Building a House

Let’s talk numbers. The average cost of building a house can vary widely depending on factors like location size and materials. But here’s a general breakdown to give you an idea of what to expect.

- Land: 20-30% of total budget

- Foundation: 15-20% of total budget

- Structure: 30-40% of total budget

- Finishes: 15-25% of total budget

- Utilities: 10-15% of total budget

- Landscaping: 5-10% of total budget

- Contingency: 10-20% of total budget

These percentages are just guidelines your actual costs may vary. Always get multiple quotes and compare prices before making any decisions.

Uncovering Hidden Costs in Construction

Let’s face it hidden costs are a part of every construction project. But that doesn’t mean you have to be blindsided by them. Here are some common hidden costs to watch out for.

- Design Changes: Making changes to your plans mid-project can be expensive so try to finalize everything upfront.

- Material Shortages: Supply chain issues can lead to delays and increased costs so plan accordingly.

- Weather Delays: Bad weather can slow down construction causing delays and additional expenses.

- Regulatory Changes: New laws or regulations can impact your project so stay informed.

By being aware of these potential pitfalls you can take proactive steps to minimize their impact on your budget.

Financing Options for Your Dream Home

Now let’s talk about how you’re going to pay for all this. There are several financing options available for building a house and each has its pros and cons.

- Mortgage Loans: Traditional home loans are a popular choice for financing construction projects. They offer competitive interest rates and flexible terms.

- Construction Loans: These are short-term loans specifically designed for building projects. They’re typically converted to permanent mortgages once construction is complete.

- Savings: If you have the means paying cash can save you money on interest and fees. But it’s not always the best option depending on your financial situation.

Consult with a financial advisor or mortgage broker to determine which option is best for you. And remember always read the fine print before signing any agreements.

Practical Tips for Staying Within Budget

Staying within budget requires discipline and smart decision-making. Here are some practical tips to help you keep your costs in check.

- Shop Around: Get multiple quotes for everything from contractors to materials. A little extra effort can save you big bucks.

- Stick to Your Plan: Avoid making unnecessary changes once construction begins. Every change order can add up quickly.

- DIY When Possible: If you have the skills consider tackling some tasks yourself. Just make sure you know what you’re doing to avoid costly mistakes.

Remember the key to staying within budget is planning and communication. Keep lines of communication open with your contractor and don’t be afraid to ask questions.

Common Mistakes to Avoid When Budgeting

Finally let’s talk about some common mistakes people make when budgeting for their dream home. Avoiding these pitfalls can save you a lot of headaches and money in the long run.

- Underestimating Costs: Always pad your budget to account for unexpected expenses.

- Ignoring Contingency: A contingency fund is not optional it’s essential for any construction project.

- Skipping Permits: Building without the proper permits can lead to legal issues and costly fines.

By learning from others’ mistakes you can avoid making the same ones yourself. Stay informed and proactive throughout the entire process.

Useful Tools for Managing Your Construction Budget

There are plenty of tools available to help you manage your construction budget more effectively. Here are a few worth checking out.

- Spreadsheets: A simple yet powerful tool for tracking expenses and staying organized.

- Budgeting Apps: Apps like PocketGuard or Mint can help you monitor your spending in real-time.

- Project Management Software: Tools like Trello or Asana can keep you and your team on the same page.

Find the tools that work best for you and integrate them into your workflow. Technology can be a huge asset when it comes to managing complex projects like building a house.

Final Thoughts and Next Steps

Building a house is a monumental undertaking but with the right budgeting strategies and tools you can make it a rewarding experience. Remember to plan carefully stay flexible and communicate openly with your team. And most importantly don’t forget to enjoy the process. After all you’re creating a home that will be a part of your life for years to come.

So what’s next? Take the first step today by defining your goals and researching costs. The sooner you start planning the sooner you’ll be living in your dream home. And don’t forget to share this article with anyone you know who’s thinking about building a house. Together we can make smart financial decisions and turn dreams into reality.