Alright folks, let’s dive right into it. The U.S. banking sector has been hit hard with layoffs in 2023, and it’s not just numbers we’re talking about—it’s real people losing jobs. If you’ve been keeping up with the news, you’ve probably seen headlines about major banks cutting thousands of positions. But what’s really going on behind the scenes? Why are these layoffs happening, and what does it mean for the average Joe or Jane? Let’s break it down for you.

This isn’t just about numbers on a spreadsheet or some fancy financial jargon. It’s about understanding why banks are making these tough decisions and how it impacts the broader economy. Whether you work in finance or not, this story affects everyone. From mortgage rates to investment portfolios, the ripple effects of these layoffs are far-reaching.

And hey, if you’re feeling a bit overwhelmed by all the buzzwords flying around, don’t worry. We’re here to simplify things for you. In this article, we’ll dig deep into the reasons behind the U.S. bank layoffs of 2023, what they mean for the future of banking, and how you can protect yourself in an uncertain economic climate. Let’s get started, shall we?

Read also:Michael Dorn The Iconic Star Trek Actor And His Enduring Legacy

Before we jump into the details, here’s a quick table of contents to help you navigate through this article. Feel free to click on any section that catches your interest:

- Reasons Behind the Layoffs

- Which Banks Are Most Affected?

- The Economic Impact of Layoffs

- What It Means for Employees

- The Future of Banking in 2023

- How to Protect Yourself

- Trends Shaping the Banking Industry

- How Customers Are Affected

- A Global Perspective on Banking Layoffs

- Final Thoughts

Reasons Behind the Layoffs

Now, let’s talk about the elephant in the room. Why are banks laying off so many employees in 2023? It’s not like they’re struggling to make money, right? Well, that’s where things get a little complicated. The truth is, the banking industry is undergoing a massive transformation, and it’s not just about profits anymore. Here are a few key reasons:

- Automation and Technology: Banks are investing heavily in AI and automation to streamline operations. This means fewer human resources are needed for tasks like data entry, customer service, and even loan approvals.

- Changing Consumer Preferences: More people are using online and mobile banking services, which reduces the need for physical branches and the staff that run them.

- Economic Uncertainty: With inflation and interest rates on the rise, banks are being cautious about their expenses. Cutting jobs is often one of the first moves they make to save costs.

So, while it might seem like a cruel decision, these layoffs are part of a larger strategy to adapt to a rapidly changing world. But that doesn’t make it any easier for the thousands of workers who are losing their jobs.

Which Banks Are Most Affected?

Not all banks are created equal, and some have been hit harder than others. Here’s a quick rundown of the major players and how they’re dealing with the layoffs:

Biggest Banks Leading the Charge

Let’s start with the big dogs. Banks like JPMorgan Chase, Bank of America, and Wells Fargo have all announced significant layoffs in 2023. These institutions are cutting jobs in areas like retail banking, mortgage lending, and even tech departments. But why are they doing it? Simple: they’re trying to stay competitive in a market that’s evolving faster than ever.

Regional Banks Feeling the Pinch

It’s not just the big guys who are feeling the heat. Smaller regional banks are also trimming their workforces to cope with declining profits and increased competition. Some of these banks are even closing branches altogether, which means fewer jobs for local communities.

Read also:Rihanna Plans 3day Wedding Bash A Celeb Extravaganza You Dont Want To Miss

But here’s the thing: not all banks are cutting jobs. Some are actually hiring in areas like cybersecurity and digital transformation. So, while it might seem like doom and gloom, there are still opportunities out there for those with the right skills.

The Economic Impact of Layoffs

When thousands of people lose their jobs, it doesn’t just affect them—it affects the entire economy. Here’s how:

- Consumer Spending Drops: When people lose their income, they tend to spend less. This can lead to a decrease in demand for goods and services, which in turn affects businesses across all sectors.

- Increased Unemployment: More layoffs mean higher unemployment rates, which can lead to social and economic challenges for communities.

- Lower Confidence: When people see headlines about mass layoffs, they start to worry about their own job security. This can lead to a decrease in consumer confidence, which further impacts the economy.

But it’s not all bad news. Some experts believe that these layoffs could lead to a more efficient and innovative banking sector in the long run. Only time will tell if that prediction holds true.

What It Means for Employees

For those who are directly affected by the layoffs, the situation can be incredibly stressful. Losing a job is never easy, especially in an uncertain economic climate. But there are steps you can take to protect yourself:

Stay Ahead of the Curve

If you work in the banking industry, it’s important to stay informed about industry trends and be proactive about developing new skills. For example, learning about AI and data analytics could make you a more valuable asset to your employer.

Network Like Crazy

Don’t underestimate the power of networking. Reach out to former colleagues, attend industry events, and join professional groups. You never know who might have a lead on a new job opportunity.

And remember, it’s not just about surviving the layoffs—it’s about thriving in a changing industry. By staying adaptable and open to new opportunities, you can turn this challenge into a chance for growth.

The Future of Banking in 2023

So, where is the banking industry headed in 2023 and beyond? The answer lies in technology. Here are a few trends to watch:

- Digital-Only Banks: More and more people are turning to online banks that offer lower fees and higher interest rates. This trend is likely to continue as younger generations embrace digital banking.

- AI-Powered Services: From chatbots to personalized investment advice, AI is transforming the way banks interact with their customers. Expect to see more of this in the coming years.

- Sustainability Focus: As consumers become more environmentally conscious, banks are starting to prioritize sustainable investing and green finance. This could be a major growth area in the future.

It’s clear that the banking industry is evolving rapidly, and those who can adapt will be the ones who succeed. But what about the rest of us? How do these changes affect the average consumer?

How to Protect Yourself

If you’re worried about the impact of U.S. bank layoffs on your financial well-being, here are a few tips to help you stay safe:

Diversify Your Income

Don’t put all your eggs in one basket. If you work in the banking industry, consider exploring other areas where your skills can be applied. Freelancing, consulting, or even starting a side business can provide a safety net if the worst happens.

Stay Informed

Keep an eye on industry news and trends. The more you know, the better prepared you’ll be to navigate any changes that come your way.

Build an Emergency Fund

This one’s a no-brainer. Having a financial cushion can make all the difference if you suddenly find yourself out of work. Aim to save at least three to six months’ worth of living expenses.

By taking these steps, you can protect yourself from the uncertainty of the banking industry and ensure that you’re ready for whatever comes your way.

Trends Shaping the Banking Industry

As we’ve already discussed, technology is driving many of the changes in the banking sector. But there are other trends to watch as well:

- Regulatory Changes: Governments around the world are cracking down on financial institutions to ensure they’re following ethical practices. This could lead to more job losses in compliance departments.

- Global Competition: With the rise of fintech companies, traditional banks are facing stiff competition. This could lead to further consolidation and layoffs as banks try to stay competitive.

- Consumer Expectations: People are demanding faster, more convenient, and more personalized banking services. Banks that can’t keep up may struggle to survive.

These trends are shaping the future of banking, and they’re likely to have a significant impact on the job market for years to come.

How Customers Are Affected

While the layoffs are primarily affecting employees, customers are feeling the impact as well. Here’s how:

- Less Personalized Service: With fewer staff available, customers may find it harder to get the attention they need when dealing with complex issues.

- Higher Fees: Some banks may try to offset their losses by charging higher fees for certain services. Keep an eye on your statements to make sure you’re not being hit with unexpected charges.

- Improved Digital Tools: On the bright side, many banks are investing in better online and mobile platforms to make up for the lack of in-person support.

So, while there are some downsides, there are also opportunities for improvement. It’s all about finding the right balance between convenience and personal service.

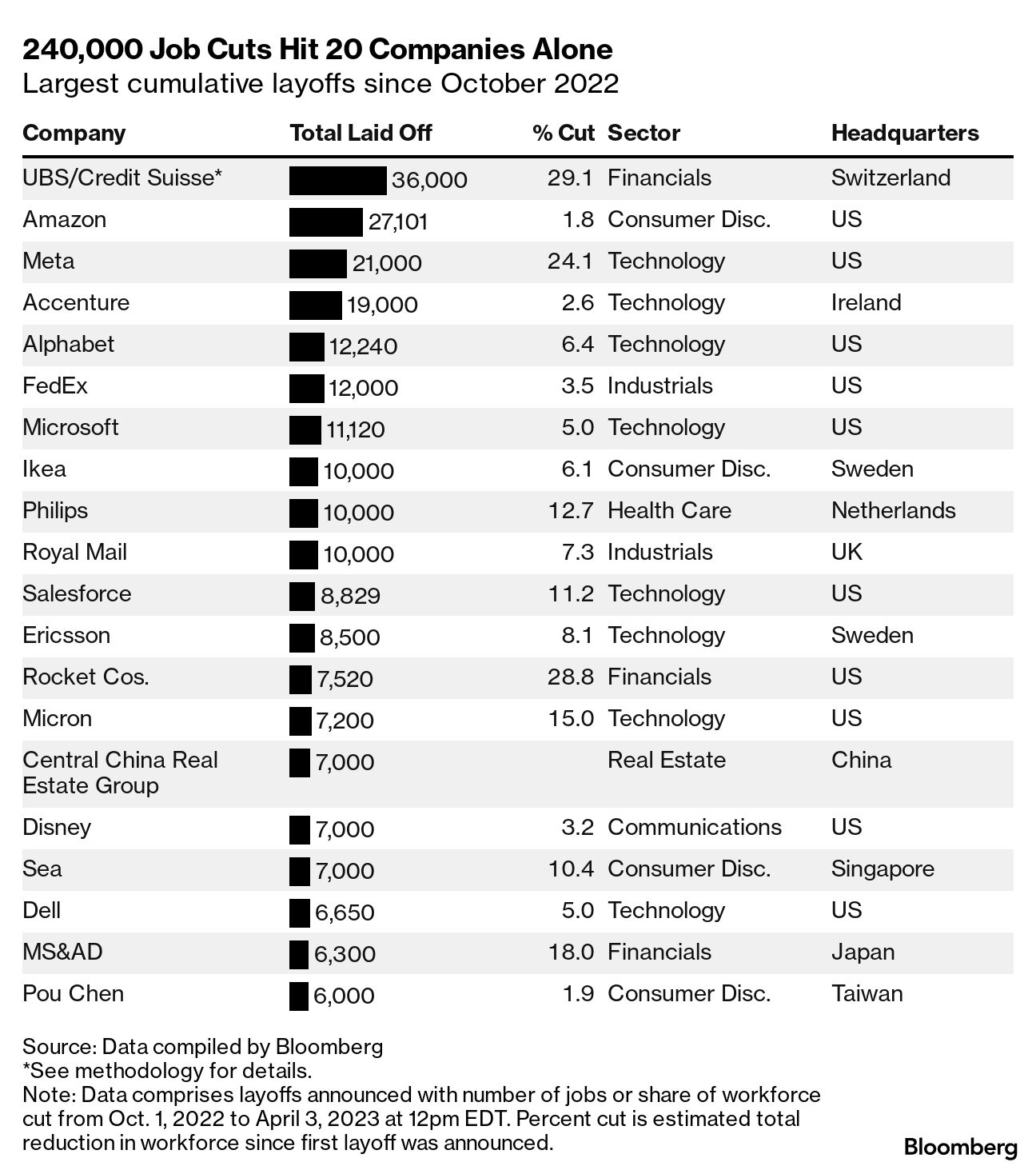

A Global Perspective on Banking Layoffs

It’s not just the U.S. that’s experiencing banking layoffs—this is a global phenomenon. Here’s how other countries are dealing with the issue:

Europe

European banks are also cutting jobs, but they’re doing it a bit differently. Many are focusing on restructuring rather than outright layoffs, which can help preserve jobs in the long run.

Asia

In Asia, the focus is on digital transformation. Many banks are hiring tech-savvy workers while cutting jobs in traditional areas like branch banking.

By looking at the global picture, we can get a better understanding of how the banking industry is evolving and what we can expect in the future.

Final Thoughts

Alright folks, that’s the lowdown on U.S. bank layoffs in 2023. While it’s not the most uplifting topic, it’s important to stay informed and prepared for what’s coming. Whether you’re an employee, a customer, or just someone interested in the financial world, these changes are going to affect us all.

Here’s a quick recap of what we’ve covered:

- The main reasons behind the layoffs include automation, changing consumer preferences, and economic uncertainty.

- Major banks like JPMorgan Chase and Bank of America are among those cutting jobs, but smaller regional banks are also feeling the pinch.

- The economic impact of layoffs is significant, but there are opportunities for growth in areas like AI and digital banking.

- For employees, staying adaptable and building a strong network can help you weather the storm.

- Customers may experience changes in service quality, but they can also benefit from improved digital tools.

So, what’s next? If you’ve found this article helpful, we’d love to hear from you. Leave a comment, share it with your friends, or check out some of our other articles on finance and economics. Together, we can navigate these uncertain times and come out stronger on the other side. Thanks for reading, and stay tuned for more insights!