Looking to rent an apartment but worried about your credit history? Nova Credit is here to change the game! Whether you're a newcomer to the US or simply trying to rebuild your financial profile, this innovative service bridges the gap between your international credit history and US landlords. It's like having a passport for your financial trustworthiness. Let's dive in and explore how Nova Credit can help you meet apartment requirements seamlessly.

Picture this: You've just landed in the US, ready to start a new chapter in your life. But wait, there's one hurdle you didn't anticipate—renting an apartment. Most US landlords require a spotless credit score, which can be tricky if you're new to the country. That's where Nova Credit steps in. This platform allows you to leverage your international credit history, making it easier to meet rental requirements without starting from scratch.

But what exactly are the Nova Credit for apartments requirements? How does it work, and why should you trust it? In this guide, we’ll break it all down for you. From the basics to advanced tips, we'll ensure you're equipped with everything you need to know. Let's get started!

Read also:Guardians Trade Jones Freeman Deal A Major League Shakeup

Table of Contents

- What is Nova Credit?

- How Does Nova Credit Work?

- Nova Credit for Apartments Requirements

- Using Your International Credit History

- Benefits of Nova Credit for Renters

- Common Questions About Nova Credit

- Trust and Security with Nova Credit

- Nova Credit from a Landlord’s Perspective

- Tips for Nova Credit Applicants

- Conclusion: Unlock Your Rental Potential

What is Nova Credit?

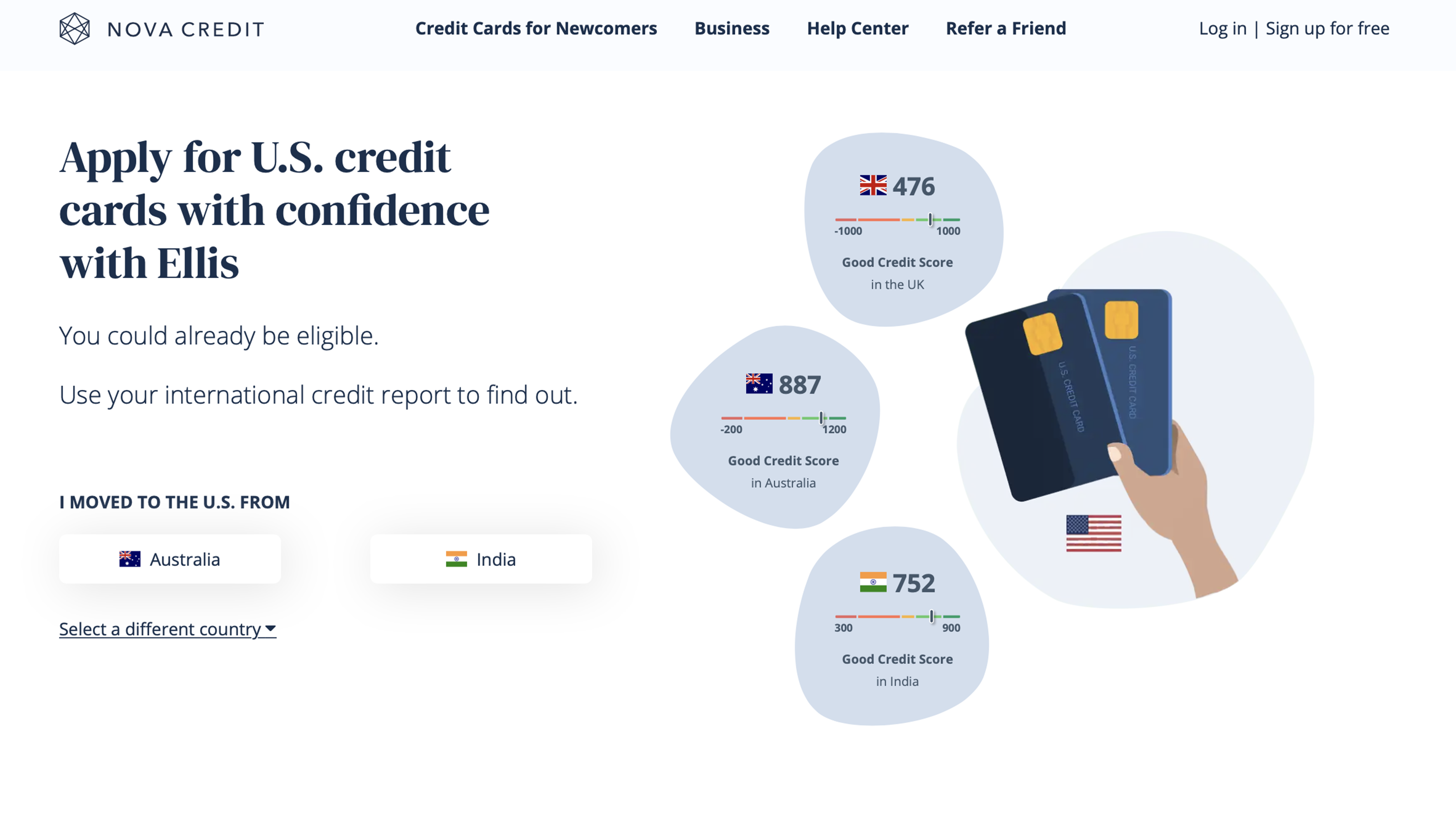

Nova Credit is like a financial translator for the global citizen. Imagine walking into a US apartment complex and confidently saying, "Hey, I've got proof of my financial responsibility from my home country!" That's exactly what Nova Credit offers. It connects your international credit history to US-based systems, giving landlords a clear picture of your financial reliability.

Founded in 2015, Nova Credit has become a trusted name for immigrants and expats navigating the US rental market. It partners with credit bureaus worldwide, ensuring your credit story doesn't get lost when you cross borders. So, whether you're coming from Canada, India, or Germany, Nova Credit can help translate your credit history into a language US landlords understand.

Why Nova Credit Matters

Traditional US credit systems can feel exclusionary for newcomers. Without a US Social Security Number (SSN), building credit can seem impossible. Nova Credit flips that narrative by allowing you to use your existing credit history as a stepping stone. It's not just about convenience—it's about fairness and accessibility.

How Does Nova Credit Work?

Alright, let's break it down. Nova Credit operates by partnering with global credit bureaus to access your credit data from your home country. Here's a simplified step-by-step process:

- Connect Your Credit History: Nova Credit links with your home country's credit bureau to retrieve your credit report.

- Translate the Data: The platform converts your credit history into a format US landlords and lenders can understand.

- Share with Landlords: Once you authorize it, Nova Credit shares your translated credit report with your chosen landlord or property management company.

It's important to note that Nova Credit doesn't create a US credit score for you. Instead, it provides a detailed report that highlights your creditworthiness based on your international history. This makes it a powerful tool for anyone looking to rent an apartment in the US.

Nova Credit for Apartments Requirements

So, what exactly do landlords look for when reviewing a Nova Credit report? Here's the lowdown:

Read also:Jacqui Heinrich The Woman Whos Taking The World By Storm

1. Credit History Length: Landlords typically prefer applicants with a long credit history. If you've been managing credit responsibly for years in your home country, that works in your favor.

2. Payment History: Consistent on-time payments are crucial. Landlords want to see proof that you've been reliable with your financial obligations.

3. Credit Utilization: This refers to how much of your available credit you've used. A lower credit utilization ratio is generally seen as positive.

Other Factors Landlords Consider

While Nova Credit provides a strong foundation, landlords may also consider other factors like:

- Income verification

- Rental history (if applicable)

- Employment status

Remember, each landlord has their own set of criteria. Nova Credit helps level the playing field by providing a comprehensive view of your financial responsibility.

Using Your International Credit History

Your international credit history is more than just a number—it's a story of your financial journey. Nova Credit taps into this story by pulling data from credit bureaus in countries like:

- Canada

- India

- Mexico

- UK

- Germany

By leveraging this data, Nova Credit creates a detailed report that highlights your credit behaviors, such as:

- Loan repayments

- Credit card usage

- Utility payments

This information gives landlords confidence in your ability to manage rent payments responsibly.

Benefits of Nova Credit for Renters

Here's why Nova Credit is a game-changer for renters:

- No SSN Required: You don't need a US Social Security Number to use Nova Credit.

- Global Coverage: Supported in multiple countries, making it accessible to a wide range of international applicants.

- Time-Saving: The process is streamlined, saving you time and hassle during the rental application process.

- Reliable: Nova Credit partners with trusted credit bureaus worldwide, ensuring the accuracy and reliability of your report.

For many renters, Nova Credit eliminates the stress of starting from scratch in a new country. It's like bringing your financial reputation with you, wherever you go.

Common Questions About Nova Credit

Q: Is Nova Credit Free?

Most Nova Credit services are free for users. However, some premium features or specific reports may come with a fee. Always check their official website for the latest pricing details.

Q: Can I Use Nova Credit for Loans?

Absolutely! While this guide focuses on apartments, Nova Credit can also be used to apply for loans, credit cards, and other financial products in the US.

Q: Is My Data Secure?

Yes, Nova Credit adheres to strict data protection standards. Your information is encrypted and handled with the utmost care.

Trust and Security with Nova Credit

Security is a top priority for Nova Credit. The platform uses advanced encryption technology to protect your sensitive information. Plus, it complies with international data protection regulations, ensuring your peace of mind.

But don't just take our word for it. Nova Credit has been trusted by thousands of users worldwide, and its partnerships with major credit bureaus speak volumes about its reliability.

Nova Credit from a Landlord’s Perspective

Landlords love Nova Credit because it simplifies the tenant screening process. Instead of relying solely on verbal promises or incomplete information, they can review a detailed credit report that paints a clear picture of an applicant's financial responsibility.

Moreover, Nova Credit helps landlords attract a broader pool of applicants, including international tenants who might otherwise be overlooked. This diversity can lead to stronger tenant relationships and better property management outcomes.

Tips for Nova Credit Applicants

Here are a few tips to make the most of Nova Credit:

- Start Early: Begin the Nova Credit process as soon as you start apartment hunting.

- Double-Check Your Data: Ensure all the information in your credit report is accurate before sharing it with landlords.

- Be Proactive: If you anticipate any issues with your credit history, address them upfront with your potential landlord.

By following these tips, you'll increase your chances of successfully renting your dream apartment.

Conclusion: Unlock Your Rental Potential

Nova Credit for apartments requirements isn't just a tool—it's a lifeline for international renters navigating the US market. By leveraging your international credit history, you can demonstrate your financial responsibility and secure your ideal living space.

Remember, the key to success is preparation and transparency. Whether you're a newcomer to the US or a seasoned expat, Nova Credit can help you bridge the gap between your past financial achievements and your future rental opportunities.

So, what are you waiting for? Head over to Nova Credit's website, sign up, and take the first step toward your dream apartment. And don't forget to share this guide with fellow renters who might find it helpful!