So, here's the deal—tracking your investments isn't just about keeping tabs on numbers. It's about making smarter decisions, understanding your financial health, and ultimately growing your wealth. And guess what? That's where Sharesight Portfolio Tracker comes in. This powerful tool is designed to help investors like you take control of their portfolios with ease, accuracy, and confidence.

Imagine this—you're scrolling through your brokerage statements, trying to figure out whether you're actually making progress or just spinning your wheels. Sound familiar? Yeah, it happens to the best of us. But here's the thing: what if you could have a single platform that not only tracks all your investments but also gives you insights into how well they're performing? Enter Sharesight, the game-changing portfolio tracker that’s turning heads in the investment world.

Now, before we dive deep into the nitty-gritty of Sharesight Portfolio Tracker, let's get one thing straight—it's not just another app. This tool is packed with features that cater to both beginners and seasoned investors. Whether you're managing a small portfolio or overseeing a multi-million-dollar fund, Sharesight has got your back. So, buckle up, because we're about to break it all down for you.

Read also:Musk Vs Senator Tesla Drama Unfolds

What Exactly is Sharesight Portfolio Tracker?

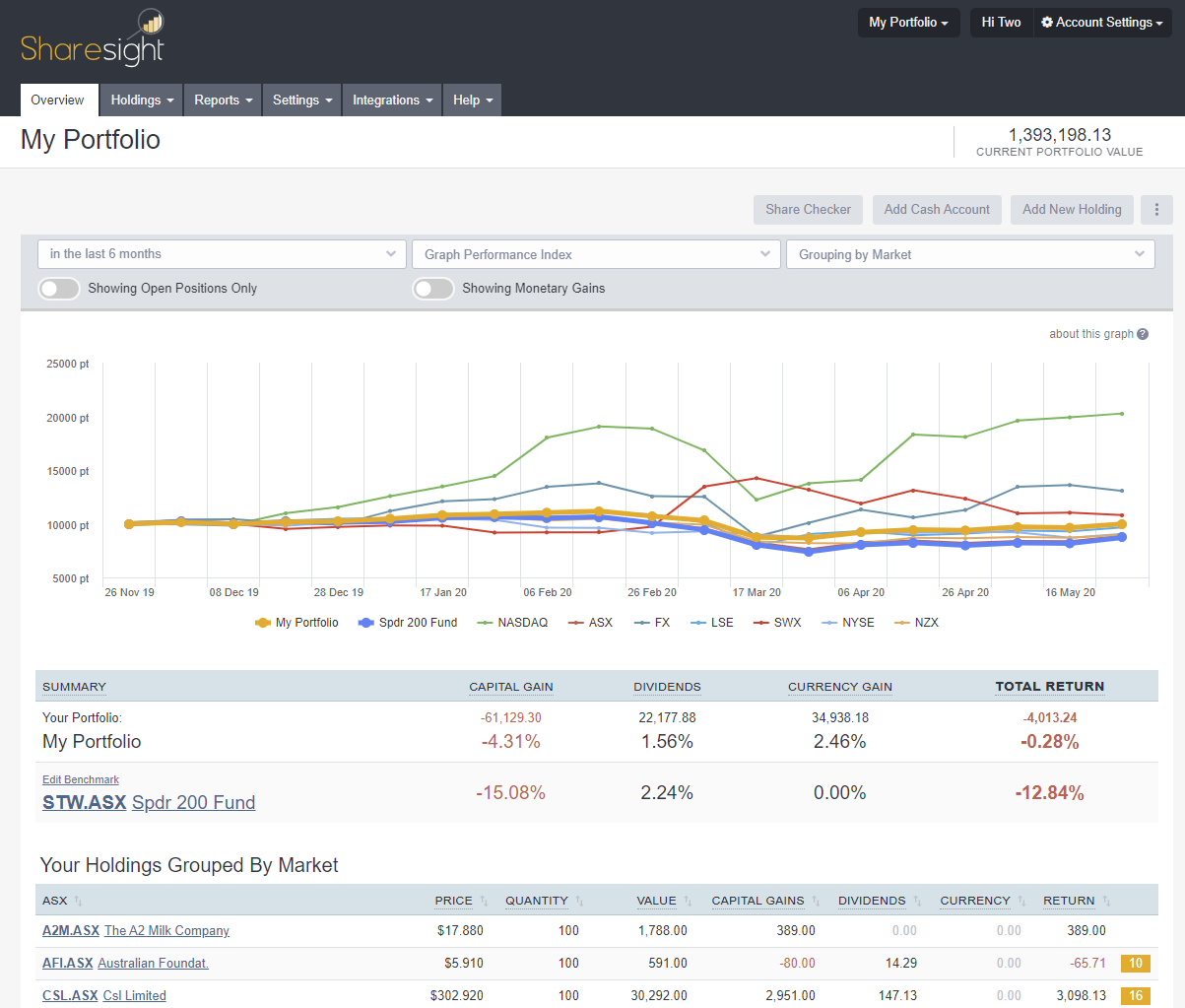

Let's start with the basics. Sharesight Portfolio Tracker is a cloud-based investment management platform designed to simplify the process of tracking and analyzing your investments. Think of it as your personal financial assistant that works around the clock to keep you informed and on track. It's more than just a tracker—it's a comprehensive tool that helps you understand your portfolio's performance, manage tax obligations, and even plan for the future.

One of the standout features of Sharesight is its ability to integrate with a wide range of brokers and financial institutions. This means you can sync all your accounts in one place, eliminating the need for manual entry and reducing the risk of errors. Plus, it offers real-time updates, so you're always in the loop when it comes to market movements and your portfolio's performance.

Why Choose Sharesight Over Other Portfolio Trackers?

Here's the thing—there are plenty of portfolio trackers out there, but not all of them are created equal. So, what makes Sharesight stand out from the crowd? For starters, it offers a level of customization that's hard to beat. You can tailor the platform to suit your specific needs, whether you're focused on capital gains, dividends, or overall performance.

Another key advantage of Sharesight is its focus on tax reporting. If you've ever spent hours crunching numbers to calculate your capital gains tax, you'll appreciate how Sharesight automates this process. It provides detailed reports that make tax season a breeze, saving you time and potentially money.

Key Features of Sharesight Portfolio Tracker

Now that we've established what Sharesight is, let's take a closer look at its key features. These are the things that make it an indispensable tool for anyone serious about their investments.

1. Seamless Integration

Sharesight supports automatic data imports from over 100 brokers worldwide. This means you can connect your accounts in minutes and start tracking your investments right away. No more manual entry or tedious spreadsheet work.

Read also:Rapper Sauce Walka Shot In Memphis The Shocking Incident That Shook The Music World

2. Comprehensive Performance Analysis

Understanding your portfolio's performance is crucial, and Sharesight makes it easy. The platform offers a range of metrics, including time-weighted and money-weighted returns, to give you a complete picture of how your investments are doing.

3. Tax Reporting Made Easy

Tax season doesn't have to be stressful. Sharesight generates detailed reports that simplify the process of filing your capital gains tax. It even takes into account dividends, currency conversions, and other factors that can affect your tax obligations.

4. Multi-Currency Support

Investing in international markets? No problem. Sharesight supports multiple currencies, allowing you to track your global investments with ease. It also handles currency conversions automatically, ensuring your numbers are always accurate.

5. Customizable Reports

Whether you need a quick overview or a detailed analysis, Sharesight lets you create custom reports to suit your needs. You can export these reports in various formats, making it easy to share them with your accountant or financial advisor.

How Sharesight Portfolio Tracker Can Boost Your Investment Strategy

So, how exactly can Sharesight help you become a better investor? Let's break it down into a few key areas:

- Improved Decision-Making: With access to real-time data and performance analytics, you can make more informed decisions about your investments.

- Enhanced Portfolio Management: Sharesight helps you stay organized and on top of your game, ensuring you don't miss a beat when it comes to managing your portfolio.

- Better Tax Planning: By automating the tax reporting process, Sharesight saves you time and reduces the risk of errors, allowing you to focus on what really matters—growing your wealth.

6. Risk Management Tools

Investing always comes with a certain level of risk, but Sharesight helps you mitigate that risk by providing tools to analyze and manage it. You can set up alerts for specific events, such as market movements or changes in your portfolio's value, so you're always prepared.

The Benefits of Using Sharesight Portfolio Tracker

Let's face it—investing can be overwhelming, especially if you're juggling multiple accounts and trying to keep track of everything manually. That's where Sharesight comes in, offering a range of benefits that make life easier for investors.

7. Time-Saving Features

One of the biggest advantages of Sharesight is its ability to save you time. By automating tasks like data entry and tax reporting, it frees up your schedule so you can focus on more important things, like researching new investment opportunities or spending time with loved ones.

8. Increased Accuracy

Manual data entry is not only time-consuming but also prone to errors. Sharesight eliminates this risk by syncing directly with your brokerage accounts, ensuring your data is always accurate and up-to-date.

9. Enhanced Security

Your financial data is sensitive, and Sharesight takes security seriously. The platform uses industry-standard encryption and two-factor authentication to protect your information from unauthorized access.

Who Can Benefit from Sharesight Portfolio Tracker?

Sharesight isn't just for professional investors or financial advisors. It's a versatile tool that can be used by anyone looking to take control of their investments. Here are a few examples of who can benefit from using Sharesight:

- Beginner Investors: If you're just starting out in the world of investing, Sharesight can help you learn the ropes and build a solid foundation for your portfolio.

- Seasoned Investors: For experienced investors, Sharesight offers advanced features and analytics that can take your strategy to the next level.

- Financial Advisors: Advisors can use Sharesight to manage their clients' portfolios more efficiently and provide better insights and recommendations.

How to Get Started with Sharesight Portfolio Tracker

Ready to give Sharesight a try? Here's a quick guide to getting started:

10. Sign Up for an Account

First things first—you'll need to create an account. Head over to the Sharesight website and sign up for a free trial. This will give you access to all the platform's features for a limited time, allowing you to test it out before committing.

11. Connect Your Brokerage Accounts

Once you've signed up, it's time to connect your brokerage accounts. Sharesight supports a wide range of brokers, so chances are you'll be able to find yours in the list. Simply follow the on-screen instructions to link your accounts.

12. Start Tracking Your Investments

With your accounts connected, you can start tracking your investments. Sharesight will automatically import your data and begin generating reports, giving you instant access to valuable insights about your portfolio.

Table of Contents

- What Exactly is Sharesight Portfolio Tracker?

- Why Choose Sharesight Over Other Portfolio Trackers?

- Key Features of Sharesight Portfolio Tracker

- How Sharesight Portfolio Tracker Can Boost Your Investment Strategy

- The Benefits of Using Sharesight Portfolio Tracker

- Who Can Benefit from Sharesight Portfolio Tracker?

- How to Get Started with Sharesight Portfolio Tracker

Final Thoughts: Is Sharesight Portfolio Tracker Right for You?

At the end of the day, choosing the right portfolio tracker comes down to your individual needs and goals. But if you're looking for a powerful, user-friendly tool that can help you take your investment game to the next level, Sharesight Portfolio Tracker is definitely worth considering.

Remember, investing is a marathon, not a sprint. By using a tool like Sharesight, you can stay informed, make smarter decisions, and ultimately achieve your financial goals. So, why not give it a try? You might just find that it's the missing piece in your investment puzzle.

And hey, don't forget to share your thoughts in the comments below or check out some of our other articles for more investment tips and tricks. Your financial future is waiting—go grab it!