When it comes to estate planning, living trust in Florida en español is more than just a legal term—it’s a powerful tool to secure your family’s future. Whether you’re a resident of the Sunshine State or someone considering moving here, understanding how living trusts work can save you time, money, and stress. Let’s dive into why this is such a big deal, especially for Spanish-speaking individuals living in Florida.

Imagine this: You’ve worked hard all your life, built a home, saved up for retirement, and maybe even started a business. Now, you want to make sure that everything you’ve built goes to the people who matter most when you’re no longer around. A living trust could be the answer you’ve been looking for. But what exactly does it mean? And how does it work in Florida?

Let’s break it down. In simple terms, a living trust allows you to transfer your assets while you’re still alive, avoiding probate and ensuring your loved ones receive what’s rightfully theirs without unnecessary delays or complications. For Spanish-speaking Floridians, having resources available in their native language makes navigating these processes much easier. So, buckle up—we’re about to explore everything you need to know about living trusts in Florida.

Read also:August 24 Zodiac Sign Unpacking The Unique Traits Of Virgos

What Is a Living Trust? Why Should You Care?

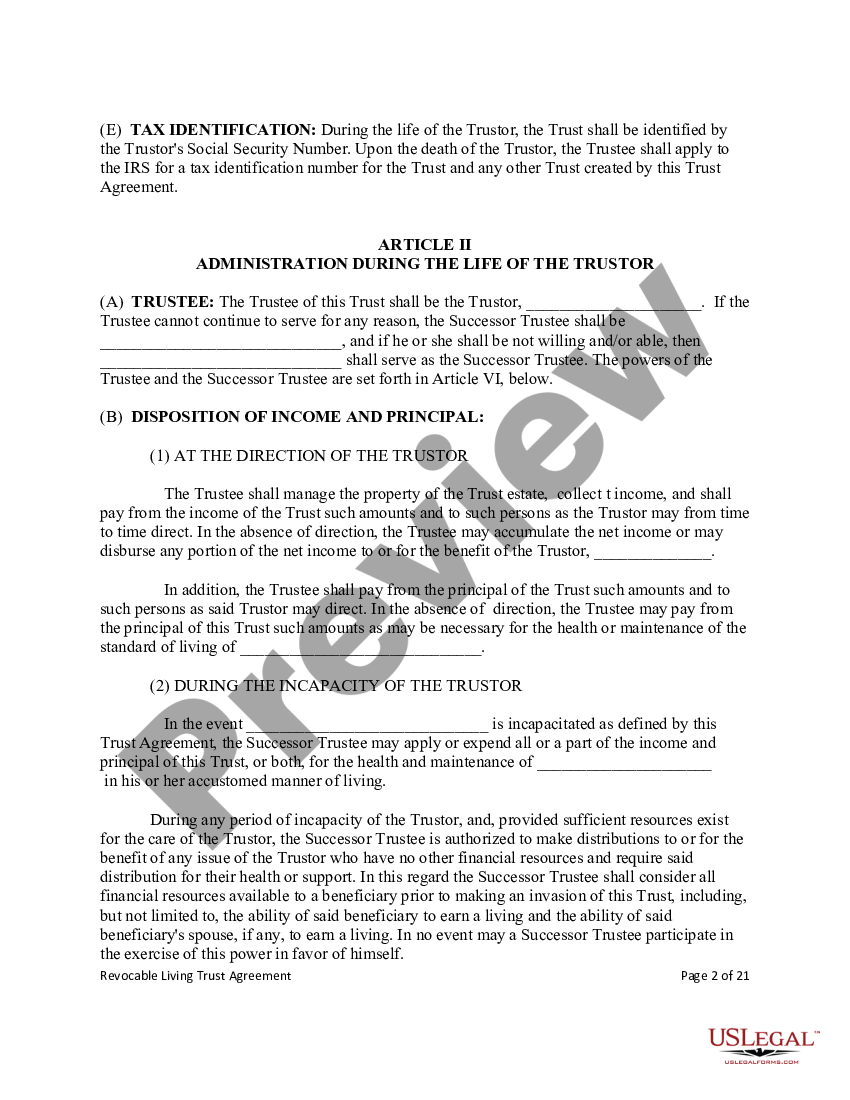

A living trust, also known as a revocable living trust, is essentially a legal document that lets you place your assets under the control of a trustee during your lifetime. This person (or entity) manages those assets according to the terms you set. The best part? Once you pass away, the trust continues to manage the distribution of your property without going through probate court.

Here’s why this matters: Probate can take months—or even years—to settle, depending on the complexity of the estate. During that time, your beneficiaries might not have access to funds they desperately need. With a living trust, everything gets distributed smoothly and efficiently, giving everyone peace of mind.

Key Benefits of Establishing a Living Trust

- Avoid Probate: One of the biggest advantages of a living trust is avoiding the lengthy and costly probate process.

- Privacy Protection: Unlike wills, which become public records after death, living trusts remain private, keeping your financial affairs out of the spotlight.

- Flexibility: Since it’s revocable, you can change or cancel the trust anytime you wish while you’re alive.

- Protection Against Incapacity: If something happens and you’re unable to manage your finances, the trustee steps in to handle things on your behalf.

Living Trust in Florida en Español: Understanding the Basics

In Florida, where over 20% of the population speaks Spanish at home, having access to estate planning resources in their native language is crucial. That’s why many attorneys and financial advisors now offer services specifically tailored to Spanish-speaking clients. But before we get into the nitty-gritty, let’s talk about some basic terms you should know:

- Testador: The person creating the trust.

- Fideicomisario: The trustee responsible for managing the trust.

- Beneficiarios: The individuals or organizations who will receive the assets from the trust.

Now, here’s the kicker: In Florida, a living trust must comply with state laws to be valid. That means working with a qualified attorney who understands both the legal requirements and cultural nuances of serving Spanish-speaking clients.

How Does a Living Trust Work in Florida?

The process starts by transferring ownership of your assets—such as real estate, bank accounts, investments, and personal belongings—into the trust. Once this is done, the trust becomes the legal owner of those assets, but you retain full control as the trustee. Here’s how it typically works:

- Create the trust document with the help of an attorney.

- Transfer assets into the trust by updating titles and account holders.

- Designate beneficiaries who will receive the assets upon your passing.

- Manage the trust during your lifetime or appoint a successor trustee.

It’s important to note that failing to properly fund the trust (i.e., transferring all relevant assets) could render it ineffective. That’s why working with an experienced professional is highly recommended.

Read also:Republic Services Leading The Way In Sustainable Waste Management

Why Choose a Living Trust Over a Will?

While both documents serve similar purposes, there are key differences between a will and a living trust. Let’s compare:

- Probate: A will must go through probate, whereas a living trust avoids it entirely.

- Privacy: Wills become public records, while living trusts remain confidential.

- Flexibility: A living trust allows for immediate management of assets if you become incapacitated.

For many Floridians, especially those with significant assets or complex family situations, a living trust offers greater security and convenience. Plus, with bilingual resources becoming increasingly available, Spanish-speaking individuals can navigate this process with confidence.

Common Misconceptions About Living Trusts

There’s a lot of misinformation floating around about living trusts, so let’s clear up a few common myths:

- Myth #1: Living trusts are only for the wealthy. Reality: Anyone with assets they care about protecting can benefit from a living trust.

- Myth #2: Creating a trust is too complicated. Reality: With the right guidance, setting up a living trust is straightforward and manageable.

- Myth #3: You lose control of your assets once they’re in the trust. Reality: As the trustee, you maintain full authority over your property until you pass away or become incapacitated.

Understanding these truths can help you make informed decisions about your estate planning.

Living Trust Costs in Florida: Is It Worth It?

Setting up a living trust does come with costs, but they’re often outweighed by the long-term benefits. According to recent surveys, the average cost of establishing a living trust in Florida ranges from $1,500 to $3,000, depending on the complexity of the estate. However, consider this:

- Avoiding probate can save thousands in court fees and attorney expenses.

- Ensuring swift asset distribution reduces stress for your loved ones.

- Protecting your privacy prevents unnecessary public scrutiny.

When you weigh these advantages against the initial investment, a living trust starts to look like a smart financial decision.

How to Save Money on Living Trusts

While hiring an attorney is highly recommended, there are ways to keep costs down:

- Do your research beforehand to streamline consultations.

- Choose a flat fee instead of an hourly rate whenever possible.

- Work with firms offering bilingual services to minimize misunderstandings.

Remember, cutting corners on estate planning can lead to bigger problems down the road. It’s always better to invest in quality legal advice upfront.

Choosing the Right Attorney for Your Living Trust

When selecting an attorney to handle your living trust, look for someone with:

- Experience in estate planning and Florida-specific laws.

- Strong communication skills, particularly if they serve Spanish-speaking clients.

- Positive reviews and testimonials from past clients.

Don’t hesitate to ask questions during your initial consultation. A good attorney should explain everything clearly and address any concerns you may have.

Questions to Ask Your Attorney

- How long have you been practicing estate planning law?

- Do you offer services in Spanish?

- What’s included in the cost of setting up a living trust?

- Can you provide examples of successful cases you’ve handled?

Being proactive in choosing the right professional ensures your living trust is set up correctly from the start.

Living Trust vs. Other Estate Planning Tools

While a living trust is one of the most effective tools for estate planning, it’s not the only option. Let’s compare it to other methods:

- Joint Ownership: Allows assets to pass directly to surviving owners but lacks flexibility.

- Payable-on-Death Accounts: Designates beneficiaries for specific accounts but doesn’t cover all assets.

- Life Insurance Policies: Provides immediate funds to beneficiaries but doesn’t manage ongoing estate needs.

Each method has its pros and cons, so it’s essential to evaluate which combination works best for your situation.

Combining Living Trusts with Other Strategies

Many experts recommend using a living trust alongside other estate planning tools for comprehensive coverage. For example:

- Create a will to cover any assets outside the trust.

- Set up durable powers of attorney for healthcare and financial decisions.

- Review beneficiary designations regularly to ensure accuracy.

This holistic approach helps ensure no stone is left unturned in protecting your legacy.

Living Trust in Florida en Español: Final Thoughts

In conclusion, a living trust in Florida en español is an invaluable resource for anyone looking to safeguard their assets and provide for their loved ones. By avoiding probate, maintaining privacy, and offering flexibility, living trusts offer peace of mind that traditional wills simply can’t match.

If you’re ready to take the next step, start by consulting with a trusted attorney who specializes in estate planning for Spanish-speaking clients. They’ll guide you through the process and help you create a plan tailored to your unique needs.

So, what are you waiting for? Take control of your future today and secure the legacy you’ve worked so hard to build.

Call to Action

Got questions about living trusts in Florida? Leave a comment below or share this article with someone who could benefit from the information. And don’t forget to check out our other resources on estate planning for more tips and insights!