Hey there, folks! If you’ve been searching for ways to take control of your financial future, then you’re in the right place. Independence Financial Network is here to guide you through the maze of investments, retirement planning, and wealth management. Whether you’re just starting out or looking to optimize your existing portfolio, this network has got your back. So, let’s dive into what makes Independence Financial Network such a game-changer in the world of finance.

Imagine having a trusted partner who understands your financial goals and helps you achieve them step by step. That’s exactly what Independence Financial Network offers. With a focus on personalized service and innovative solutions, they aim to empower individuals and businesses alike to build lasting wealth. In today’s unpredictable economy, having a solid financial plan isn’t just an option—it’s a necessity.

Now, before we get into the nitty-gritty, let’s talk about why financial independence is more than just a buzzword. It’s about creating a life where money works for you, not the other way around. Independence Financial Network is all about helping people achieve that dream, one smart investment at a time. So, grab a cup of coffee, and let’s explore how this network can revolutionize your financial journey.

Read also:Understanding The Ap Poll The Heartbeat Of College Football

Understanding Independence Financial Network

At its core, Independence Financial Network is not just another financial advisory firm. It’s a community of experts dedicated to helping clients navigate the complexities of modern finance. The network specializes in offering tailored solutions for individuals, families, and businesses, ensuring that every client gets the attention and expertise they deserve.

What Makes Independence Financial Network Stand Out?

There are plenty of financial institutions out there, but what sets Independence Financial Network apart? Here are a few reasons:

- Personalized Approach: They don’t believe in one-size-fits-all solutions. Every client gets a custom plan based on their unique needs and goals.

- Expertise and Experience: The team at Independence Financial Network brings decades of combined experience in the financial industry. You’re in good hands.

- Commitment to Education: They believe in empowering clients with knowledge, so they offer workshops, webinars, and resources to help you make informed decisions.

Whether you’re planning for retirement, managing investments, or seeking guidance on estate planning, Independence Financial Network has the tools and expertise to help you succeed.

Key Services Offered by Independence Financial Network

So, what exactly does Independence Financial Network offer? Let’s break it down:

Retirement Planning

Planning for retirement can feel overwhelming, but with Independence Financial Network, it doesn’t have to be. Their retirement planning services focus on creating a sustainable income stream that lasts throughout your golden years. By analyzing your current financial situation and projecting future needs, they craft a strategy that aligns with your vision of retirement.

Investment Management

Investing wisely is crucial for growing your wealth over time. Independence Financial Network offers a range of investment options, from traditional stocks and bonds to alternative investments. Their team monitors market trends and adjusts your portfolio as needed to maximize returns while managing risk.

Read also:Chrissy Teigen Under Fire Is She Really A Hypocrite Or Just Human

Estate Planning

Ensuring that your legacy is protected is just as important as building wealth. Independence Financial Network provides comprehensive estate planning services to help you safeguard your assets and pass them on to future generations. This includes trusts, wills, and tax planning strategies.

These services, among others, highlight the breadth of expertise Independence Financial Network brings to the table. They’re not just about managing money—they’re about helping you live the life you’ve always dreamed of.

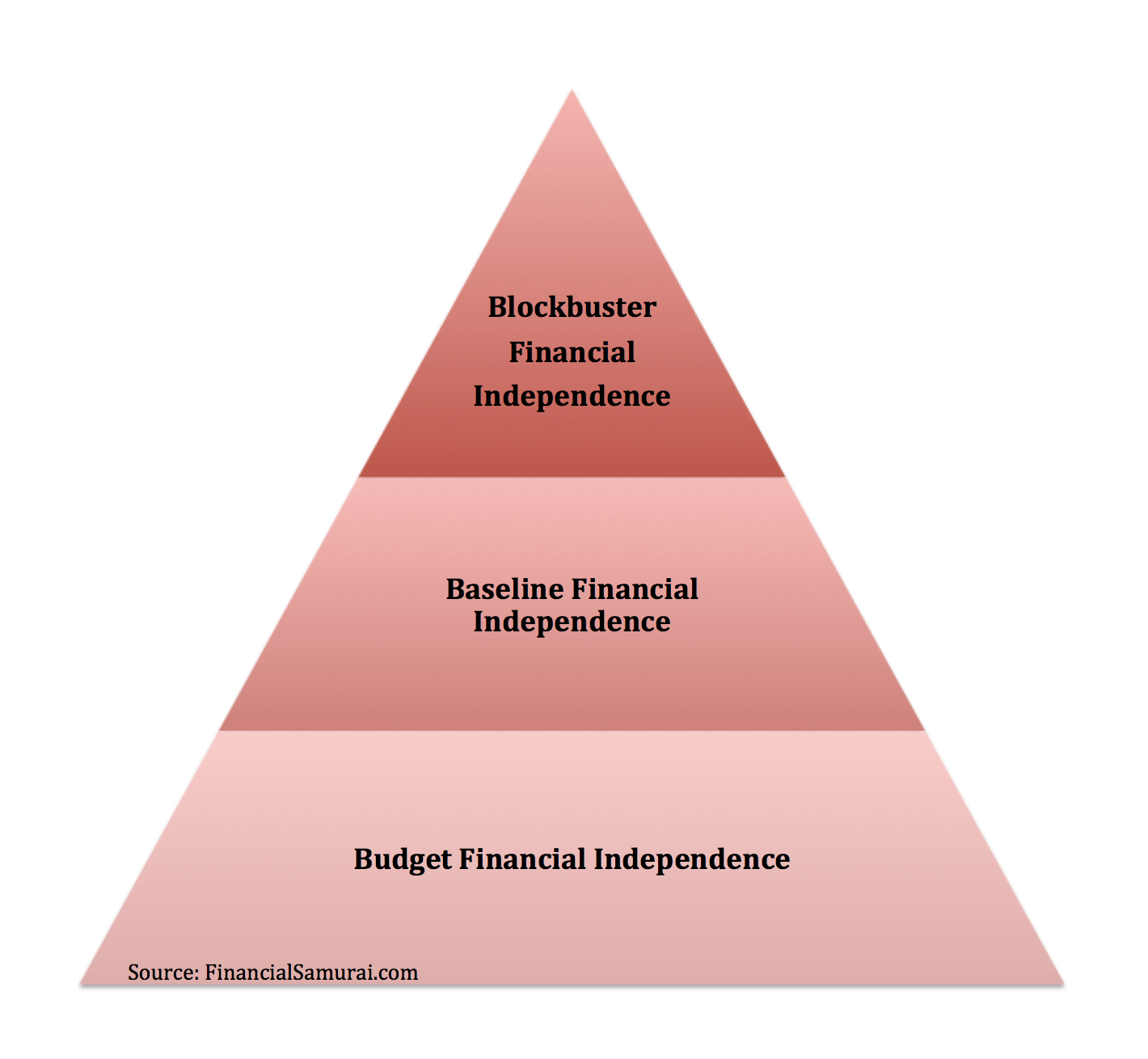

The Importance of Financial Independence

Let’s take a moment to talk about why financial independence matters so much. In a world where uncertainty seems to be the only constant, having control over your finances is empowering. Financial independence means:

- Freedom: The ability to make choices without being constrained by financial limitations.

- Security: Knowing that you’re prepared for whatever life throws your way.

- Peace of Mind: A sense of confidence that comes from having a well-thought-out financial plan.

Independence Financial Network understands these priorities and tailors their services to help clients achieve them. Whether you’re saving for a child’s education, planning for early retirement, or simply looking to grow your wealth, they’re here to support you every step of the way.

How Independence Financial Network Supports Clients

One of the hallmarks of Independence Financial Network is their commitment to client support. They go beyond offering financial advice by building relationships based on trust and transparency. Here’s how they support their clients:

Regular Check-Ins

Life changes, and so do financial needs. Independence Financial Network schedules regular meetings with clients to review their progress and make adjustments to their plans as necessary. This ensures that their strategies remain aligned with their evolving goals.

Access to Resources

Education is a cornerstone of their approach. Clients have access to a wealth of resources, including articles, videos, and seminars, to deepen their understanding of financial concepts. The more you know, the better equipped you are to make sound decisions.

Responsive Communication

Communication is key, and Independence Financial Network makes sure their clients are always in the loop. Whether it’s answering questions, providing updates, or addressing concerns, they prioritize open and honest communication.

By fostering a strong support system, Independence Financial Network helps clients feel confident and informed about their financial journey.

Success Stories from Independence Financial Network

Nothing speaks louder than real-life success stories. Here are a few examples of how Independence Financial Network has helped clients achieve their financial goals:

Case Study: John and Sarah

John and Sarah were nearing retirement but felt unsure about their financial readiness. After working with Independence Financial Network, they developed a comprehensive retirement plan that included diversifying their investments and optimizing their tax strategies. Today, they enjoy a comfortable retirement, knowing their finances are secure.

Case Study: Small Business Owner

A local small business owner partnered with Independence Financial Network to create a financial strategy that supported both personal and business growth. Through careful planning and investment management, they were able to expand their business while ensuring their personal finances remained stable.

These stories illustrate the impact Independence Financial Network can have on people’s lives. Their dedication to helping clients succeed is evident in every success story they share.

Common Misconceptions About Financial Independence

There are a lot of myths floating around about financial independence. Let’s debunk a few of them:

- Myth #1: You Need a Lot of Money to Start: False! Financial independence is achievable at any income level with the right mindset and strategies.

- Myth #2: It’s Only for the Wealthy: Anyone can work toward financial independence by making smart choices and leveraging available resources.

- Myth #3: It’s Too Late to Start: It’s never too late to take control of your finances. Even if you’re starting later in life, Independence Financial Network can help you catch up.

Independence Financial Network helps dispel these myths by providing practical advice and actionable steps to help clients achieve their financial goals.

Choosing the Right Financial Advisor

When it comes to your finances, choosing the right advisor is crucial. Here’s what to look for:

Experience and Expertise

Make sure your advisor has a proven track record of success in the financial industry. Independence Financial Network’s team boasts extensive experience in various areas of finance, ensuring they can handle whatever challenges arise.

Transparency and Trust

A good financial advisor should be transparent about their fees, strategies, and recommendations. Trust is the foundation of any successful client-advisor relationship, and Independence Financial Network builds trust through honesty and integrity.

Client-Centric Approach

Your financial advisor should prioritize your needs and goals above all else. Independence Financial Network’s client-centric approach ensures that every decision is made with your best interests in mind.

By selecting the right financial advisor, you set yourself up for long-term success. Independence Financial Network checks all the boxes when it comes to being a top-tier financial partner.

Future Trends in Financial Planning

The financial landscape is constantly evolving, and Independence Financial Network stays ahead of the curve by keeping up with the latest trends. Here are a few trends to watch:

- Sustainable Investing: More and more investors are prioritizing socially responsible investments, and Independence Financial Network offers options that align with these values.

- Technology Integration: From robo-advisors to digital platforms, technology is transforming how financial planning is done. Independence Financial Network leverages cutting-edge tools to enhance their services.

- Remote Services: With the rise of remote work, financial advisors are increasingly offering virtual consultations and online resources to meet clients where they are.

By staying informed about these trends, Independence Financial Network ensures that their clients are always on the forefront of financial innovation.

Why Trust Independence Financial Network?

Trust is everything when it comes to financial planning. Here’s why you can trust Independence Financial Network:

- Proven Track Record: They’ve helped countless clients achieve their financial goals, earning a reputation for excellence.

- Accredited Professionals: Their team consists of certified financial planners, investment advisors, and other accredited professionals.

- Client Satisfaction: Testimonials and reviews from satisfied clients speak volumes about their commitment to quality service.

When you choose Independence Financial Network, you’re choosing a partner you can rely on to guide you toward financial success.

Conclusion

In summary, Independence Financial Network is more than just a financial advisory firm—it’s a partner in your journey toward financial independence. By offering personalized services, staying ahead of industry trends, and building trust with their clients, they’ve established themselves as a leader in the field.

We encourage you to take the next step toward securing your financial future. Whether it’s scheduling a consultation, attending a webinar, or exploring their resources, Independence Financial Network is here to help. Don’t wait—start building the life you’ve always wanted today!

Table of Contents

- Understanding Independence Financial Network

- Key Services Offered by Independence Financial Network

- The Importance of Financial Independence

- How Independence Financial Network Supports Clients

- Success Stories from Independence Financial Network

- Common Misconceptions About Financial Independence

- Choosing the Right Financial Advisor

- Future Trends in Financial Planning

- Why Trust Independence Financial Network?

- Conclusion