When it comes to credit defense product wells fargo letter, you're probably wondering what all the fuss is about. Well, buckle up, because we're diving deep into this topic. Whether you're dealing with a dispute, trying to clean up your credit report, or just want to know more about how these letters work, this article has got you covered. We’ll break it down in a way that’s easy to understand, so even if you’re not a finance expert, you’ll walk away feeling like one.

Let’s face it, dealing with banks like Wells Fargo can sometimes feel like navigating a maze. But fear not! Understanding credit defense products and knowing how to write an effective letter can make all the difference. In this article, we’ll explore everything you need to know about these products, why they matter, and how to take control of your financial situation.

This isn’t just another boring guide. We’re here to give you actionable insights, tips, and tricks to help you tackle any issues you might have with Wells Fargo or any other financial institution. So, let’s get started and make sure you’re armed with the knowledge you need to protect your credit and financial future.

Read also:Discovering Kristen Rivers A Closer Look

What is a Credit Defense Product?

A credit defense product is essentially a tool or service designed to help consumers protect their credit scores and manage disputes related to their credit reports. These products often come with features like credit monitoring, identity theft protection, and assistance in resolving errors on your credit file. In the case of Wells Fargo, they offer various credit defense products aimed at helping customers maintain a healthy credit profile.

For example, if you notice discrepancies or inaccuracies on your credit report, a credit defense product can help you dispute them and work towards getting them resolved. This is where the wells fargo letter comes into play. Writing a well-crafted letter can be the first step in addressing any issues with your credit report and ensuring that your concerns are taken seriously by the bank.

Why Are Credit Defense Products Important?

Credit defense products play a crucial role in today’s financial landscape. With identity theft and fraud on the rise, having an extra layer of protection is more important than ever. These products can alert you to suspicious activity on your accounts, monitor your credit score for changes, and even assist you in disputing errors on your credit report.

Let’s be honest, no one wants to deal with the headache of a bad credit score. A low credit score can impact everything from getting approved for a loan to securing a new apartment. That’s why having access to credit defense tools can be a game-changer. They empower you to take control of your financial health and make informed decisions about your credit.

Common Features of Credit Defense Products

Here’s a quick rundown of some of the most common features you’ll find in credit defense products:

Read also:Why Arkansas Baseball Is A Mustwatch The Story Of The Razorbacks

- Credit Monitoring: Get real-time alerts whenever there’s a change in your credit report.

- Identity Theft Protection: Safeguard your personal information and prevent fraudulent activity.

- Dispute Assistance: Receive guidance and support when disputing errors on your credit report.

- Access to Credit Reports: Easily view your credit reports from all three major bureaus.

These features are designed to give you peace of mind and help you stay on top of your credit health. Whether you’re trying to improve your credit score or prevent future issues, credit defense products can be invaluable.

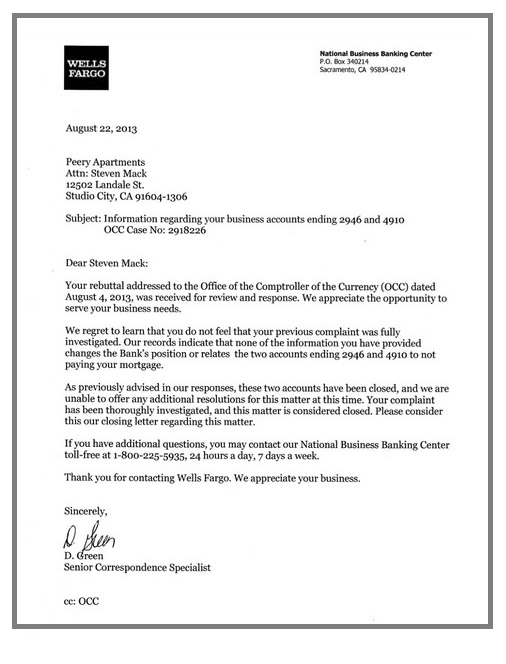

Understanding the Wells Fargo Letter

The wells fargo letter is a powerful tool in your credit defense arsenal. When you need to communicate with the bank regarding a dispute, error, or other issue, writing a clear and concise letter can make all the difference. This letter serves as your official communication with Wells Fargo, outlining your concerns and requesting action to resolve the problem.

Here’s what you need to include in your letter:

- Your full name and account information

- A detailed description of the issue or error

- Any supporting documentation or evidence

- A clear request for the action you want Wells Fargo to take

Remember, the more specific and detailed your letter is, the better your chances of getting the resolution you need. Don’t be afraid to be assertive and direct in your communication. After all, your credit and financial future are on the line.

Sample Wells Fargo Letter

Here’s an example of what your wells fargo letter might look like:

Dear Wells Fargo,

I am writing to bring to your attention an error on my credit report. Specifically, there is a late payment listed on my account for the month of January 2023, which I believe is incorrect. I have always paid my bills on time and have never missed a payment.

Attached, you will find copies of my payment records for the relevant period. Please review these documents and correct the error on my credit report as soon as possible. Failure to do so could negatively impact my credit score and financial opportunities.

Thank you for your prompt attention to this matter. I look forward to hearing from you soon regarding the resolution of this issue.

Sincerely,

Your Name

How to Write an Effective Credit Defense Letter

Writing an effective credit defense letter is all about clarity, specificity, and professionalism. Here are some tips to help you craft a letter that gets results:

- Be clear and concise in explaining the issue

- Provide all necessary details, including account numbers and dates

- Include any supporting documentation to back up your claim

- Be polite but firm in your request for action

- Keep a copy of the letter for your records

Remember, the goal is to communicate your concerns effectively and ensure that Wells Fargo takes your issue seriously. By following these tips, you’ll be well on your way to writing a letter that gets the results you need.

Common Mistakes to Avoid

Here are some common mistakes to avoid when writing your credit defense letter:

- Being too vague or unclear about the issue

- Forgetting to include necessary details like account numbers

- Not providing supporting documentation

- Using an aggressive or confrontational tone

By steering clear of these pitfalls, you’ll increase your chances of a successful outcome. Remember, the goal is to work collaboratively with Wells Fargo to resolve the issue, not to create unnecessary conflict.

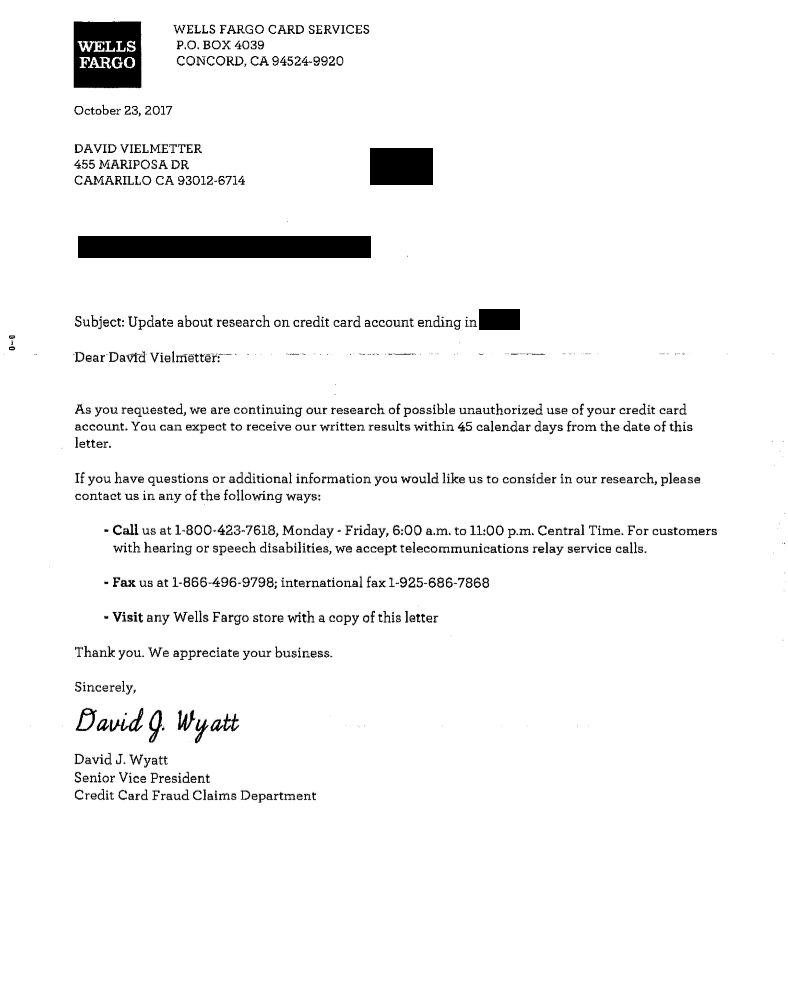

What Happens After You Send the Letter?

Once you’ve sent your wells fargo letter, what happens next? Typically, the bank will review your letter and any supporting documentation you’ve provided. They may reach out to you for additional information or clarification. It’s important to keep track of all communications and follow up if you don’t hear back within a reasonable timeframe.

If the issue is resolved in your favor, you should receive confirmation from Wells Fargo and see the changes reflected on your credit report. However, if the issue isn’t resolved to your satisfaction, you may need to escalate the matter or seek additional assistance from a credit counselor or legal professional.

Tips for Following Up

Here are some tips for following up on your letter:

- Set a timeline for when you expect to hear back

- Keep a record of all communications with the bank

- Be persistent but respectful in your follow-up efforts

- Know your rights and be prepared to escalate if necessary

By staying on top of the situation, you can ensure that your concerns are addressed and your credit is protected.

Additional Resources for Credit Defense

There are plenty of resources available to help you with credit defense and dispute resolution. Here are a few to consider:

- Credit counseling agencies

- Consumer protection agencies

- Legal professionals specializing in credit disputes

- Online forums and communities for sharing experiences and advice

These resources can provide valuable guidance and support as you navigate the credit defense process. Don’t hesitate to reach out for help if you need it. After all, your credit is one of your most valuable assets, and protecting it is worth the effort.

Final Thoughts

In conclusion, understanding credit defense product wells fargo letter is essential for anyone looking to protect their credit and financial future. By using credit defense products and writing effective letters, you can take control of your credit health and resolve any issues that arise.

We encourage you to take action today. Whether it’s writing a letter to Wells Fargo or exploring credit defense products, the sooner you address any issues, the better. And don’t forget to share this article with others who might benefit from the information. Together, we can all work towards a healthier financial future.

Table of Contents

What is a Credit Defense Product?

Why Are Credit Defense Products Important?

Common Features of Credit Defense Products

Understanding the Wells Fargo Letter

How to Write an Effective Credit Defense Letter

What Happens After You Send the Letter?

Additional Resources for Credit Defense

There you have it, folks. A comprehensive guide to navigating the world of credit defense products and wells fargo letters. Let us know in the comments if you’ve had any experiences with credit disputes or if you’ve used a credit defense product. Your stories could help others in similar situations. Until next time, stay sharp and protect your credit!