Since its launch in 2009, Bitcoin has transformed the financial landscape, becoming a global phenomenon. As the first decentralized digital currency, it has captured the attention of investors, tech enthusiasts, and everyday people alike. Whether you're just dipping your toes into the world of cryptocurrencies or you're a seasoned pro, understanding how to maximize Bitcoin's potential is crucial. Let's dive in and break it all down for you.

Bitcoin isn’t just a buzzword; it’s a revolutionary concept that’s sparking conversations about the future of money, security, and financial independence. With its decentralized structure and limited supply, it’s no wonder investors are drawn to it as a stable and growing asset. However, navigating the complex world of Bitcoin isn’t always easy. To truly harness its power, you need a solid grasp of its benefits, risks, and strategies.

In this comprehensive guide, we’ll walk you through everything you need to know about Bitcoin—from its history and key features to investment strategies and security tips. By the time you’re done reading, you’ll have the tools and insights to confidently incorporate Bitcoin into your financial portfolio. So, buckle up, and let’s explore the exciting world of Bitcoin together!

Read also:Snowstorms Your Ultimate Guide To Staying Safe And Informed

Table of Contents

- Getting to Know Bitcoin

- The Origins of Bitcoin

- What Sets Bitcoin Apart?

- Why Bitcoin Matters

- Navigating the Risks

- Smart Strategies for Investing in Bitcoin

- Keeping Your Bitcoin Safe

- Understanding the World of Bitcoin Mining

- The Regulatory Landscape

- Where Is Bitcoin Headed?

- Common Questions About Bitcoin

Getting to Know Bitcoin

Bitcoin is more than just a digital currency—it’s a groundbreaking technology that operates on a peer-to-peer network without the need for banks or intermediaries. Launched in 2009 by the mysterious figure (or group) known as Satoshi Nakamoto, Bitcoin relies on blockchain technology to ensure transparency, security, and immutability in every transaction. Think of it as a digital ledger that records every movement of Bitcoin, making it nearly impossible to manipulate or cheat the system.

What Makes Bitcoin Unique?

So, what sets Bitcoin apart from traditional currencies? For starters, it’s decentralized, meaning no single entity controls it. Governments can’t interfere, and banks aren’t needed to process transactions. Plus, there’s a hard limit of 21 million Bitcoins, ensuring scarcity and potentially driving up value over time. And let’s not forget transparency—every transaction is publicly recorded on the blockchain, fostering trust and accountability.

These unique characteristics have propelled Bitcoin to become a household name in the world of finance. From being a niche idea to becoming a globally recognized asset, Bitcoin’s journey has been nothing short of remarkable.

The Origins of Bitcoin

Bitcoin’s story begins in 2008 with the release of a whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" by Satoshi Nakamoto. The following year, the first Bitcoin block, known as the Genesis Block, was mined, officially launching the currency. Since then, Bitcoin has grown exponentially, capturing the attention of millions around the world and becoming the largest cryptocurrency by market capitalization.

Milestones in Bitcoin's Journey

Bitcoin’s rise hasn’t been without its defining moments. In 2010, a historic event occurred when someone purchased two pizzas for 10,000 BTC, marking the first real-world transaction using Bitcoin. Fast forward to 2013, and Bitcoin surged past the $1,000 mark, signaling a major milestone in its adoption. By 2017, Bitcoin reached an all-time high of nearly $20,000, sparking widespread interest and cementing its place in the financial world.

These milestones highlight Bitcoin’s evolution from a fringe concept to a globally recognized asset, proving that its impact on the financial landscape is here to stay.

Read also:Githubgames Revolutionizing Game Development Through Collaboration

What Sets Bitcoin Apart?

Bitcoin’s appeal lies in its distinctive features, which set it apart from traditional financial systems. Here’s a closer look at what makes Bitcoin so special:

1. Decentralization

Unlike traditional currencies, Bitcoin operates without a central authority. This means users can transact directly with one another without needing banks or financial institutions. It’s like cutting out the middleman, giving users more control over their money.

2. Security

Bitcoin transactions are secured through advanced cryptographic techniques, making them nearly impossible to alter or reverse. The blockchain ensures that every transaction is permanently recorded, adding an extra layer of security to the system.

3. Transparency

Every Bitcoin transaction is visible on the blockchain, providing full transparency and accountability. This openness builds trust among users and ensures that the system remains fair and honest.

Why Bitcoin Matters

Bitcoin offers a host of benefits that make it an attractive option for both individuals and businesses. Let’s explore some of the key advantages:

1. Global Accessibility

Bitcoin can be used anywhere in the world without the hassle of currency conversion or exorbitant transaction fees. Whether you’re sending money across the globe or making international purchases, Bitcoin simplifies the process and saves you money.

2. Lower Transaction Fees

Compared to traditional banking systems, Bitcoin transactions typically involve lower fees. This makes it an appealing choice for businesses looking to reduce costs and for individuals seeking a more affordable way to manage their finances.

3. Financial Independence

By eliminating the need for intermediaries, Bitcoin empowers users to take control of their finances. It’s like having your own personal bank account that you control entirely, fostering financial independence and empowerment.

Navigating the Risks

While Bitcoin offers many benefits, it’s not without its challenges. Here are some key risks to consider:

1. Volatility

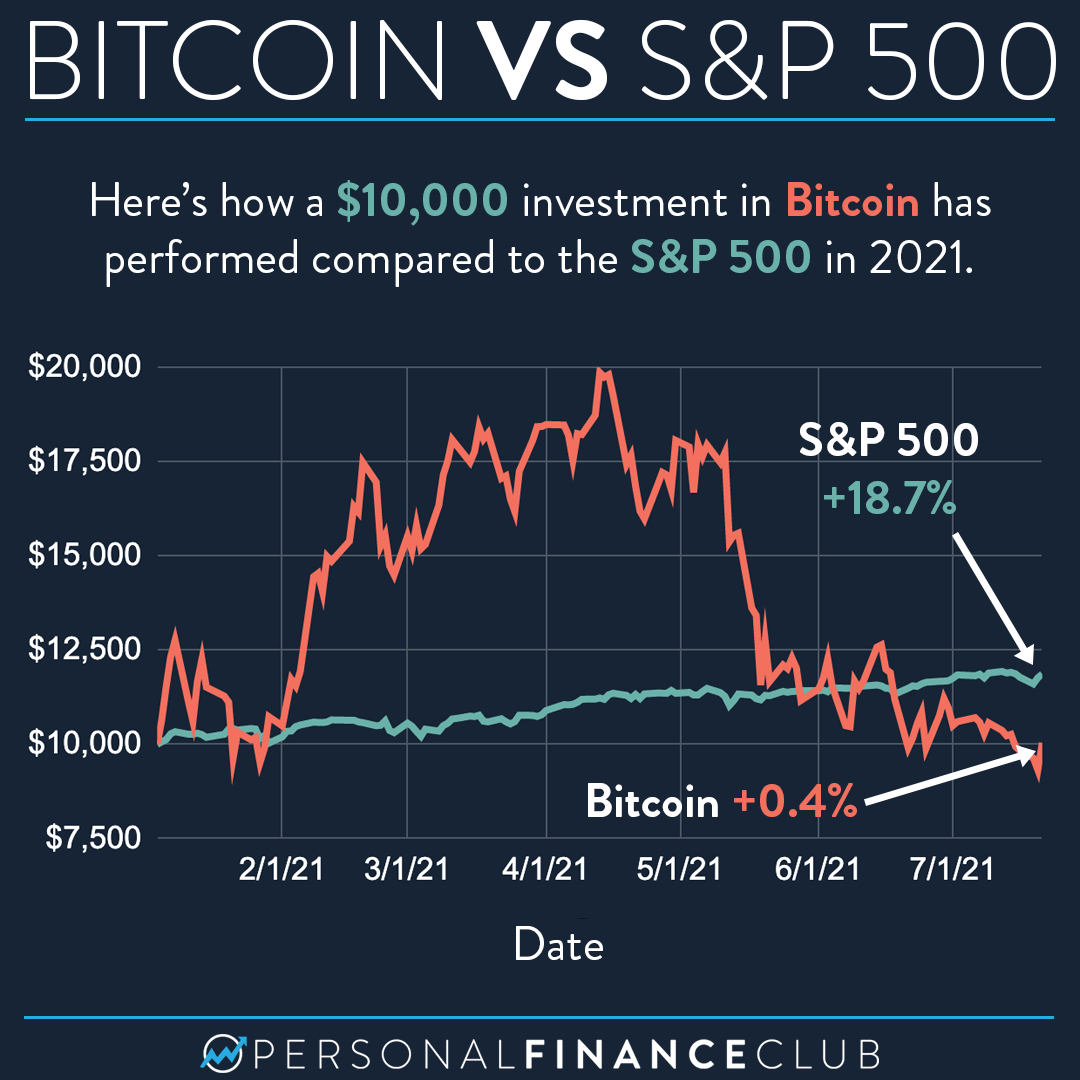

Bitcoin’s price can be unpredictable, often swinging dramatically in short periods. While this volatility can lead to significant gains, it can also result in substantial losses. If you’re looking for stability, Bitcoin might not be the best fit.

2. Security Threats

Although Bitcoin transactions themselves are secure, users must take steps to protect their private keys and wallets. Cybersecurity threats such as hacking and phishing are real concerns, so staying vigilant is essential.

3. Regulatory Uncertainty

Regulations surrounding Bitcoin vary widely from country to country, creating uncertainty for users and businesses. This inconsistency can impact its adoption and usage in certain regions, so staying informed about local laws is crucial.

Smart Strategies for Investing in Bitcoin

If you’re considering investing in Bitcoin, it’s important to approach it strategically. Here are some top strategies to help you maximize your returns while minimizing risks:

1. Dollar-Cost Averaging

Instead of investing a large lump sum, consider using dollar-cost averaging. This method involves buying Bitcoin in smaller, regular increments over time. By spreading out your purchases, you reduce the impact of market volatility on your investment.

2. Long-Term Holding

Many investors choose to hold onto their Bitcoin for the long haul, believing that its value will increase over time. This strategy requires patience and faith in Bitcoin’s potential, but it can pay off in the long run.

3. Diversification

To spread your risk, consider diversifying your investment portfolio by including other cryptocurrencies or asset classes. This approach helps balance your portfolio and increases your chances of achieving positive returns.

Keeping Your Bitcoin Safe

Securing your Bitcoin is critical to protecting your investment. Here are some best practices to keep your digital currency safe:

1. Use Hardware Wallets

Hardware wallets are physical devices that store your Bitcoin offline, making them highly secure. They offer an extra layer of protection against cyber threats, ensuring your Bitcoin remains safe even in the face of online attacks.

2. Enable Two-Factor Authentication

Two-factor authentication adds an additional layer of security to your Bitcoin accounts, making it harder for hackers to gain unauthorized access. It’s a simple but effective way to safeguard your digital assets.

3. Backup Your Private Keys

Always keep a secure backup of your private keys in a safe location. This ensures that you can recover your Bitcoin in case of loss or damage, giving you peace of mind knowing your investment is protected.

Understanding the World of Bitcoin Mining

Bitcoin mining is the process of verifying and adding transactions to the blockchain. Miners use powerful computers to solve complex mathematical puzzles, earning Bitcoin as a reward for their efforts. It’s like a digital gold rush, where miners compete to solve problems and add new blocks to the chain.

How Does Bitcoin Mining Work?

Here’s a breakdown of the mining process:

- Miners use computational power to solve cryptographic puzzles.

- Once a puzzle is solved, the miner adds a new block of transactions to the blockchain.

- The miner receives a reward in the form of newly minted Bitcoin and transaction fees.

Mining plays a vital role in maintaining the security and integrity of the Bitcoin network, ensuring that it remains trustworthy and reliable.

The Regulatory Landscape

Regulations surrounding Bitcoin vary by country, with some embracing it wholeheartedly while others impose strict restrictions. Understanding the legal landscape is essential for anyone using or investing in Bitcoin.

Key Considerations

When navigating Bitcoin regulations, keep the following in mind:

- Check the legal status of Bitcoin in your country to ensure compliance.

- Be aware of anti-money laundering (AML) and know-your-customer (KYC) regulations that may apply.

- Consult with legal professionals to fully understand your rights and obligations.

Staying informed about regulatory developments is crucial for making smart decisions about Bitcoin.

Where Is Bitcoin Headed?

The future of Bitcoin looks bright, with increasing adoption and innovation driving its growth. As more businesses and institutions embrace Bitcoin, its role in the global financial system is likely to expand. It’s not just about being a currency anymore—it’s about reshaping how we think about money and value.

Trends to Watch

Here are some key trends shaping Bitcoin’s future:

- Increased investment from institutional players, signaling confidence in Bitcoin’s long-term potential.

- Advancements in blockchain technology that enhance scalability and efficiency, making Bitcoin more accessible and practical.

- Greater acceptance of Bitcoin as a payment method by retailers and service providers, further integrating it into everyday life.

These trends suggest that Bitcoin will continue to play a pivotal role in shaping the future of finance, making it an asset worth watching closely.

Common Questions About Bitcoin

1. Is Bitcoin a Good Investment?

Bitcoin can be a great investment for those willing to embrace its volatility and risks. Its limited supply and potential for growth make it an attractive option for long-term investors who believe in its future.

2. How Do I Buy Bitcoin?

You can purchase Bitcoin through cryptocurrency exchanges, peer-to-peer platforms, or Bitcoin ATMs. Just be sure to choose a reputable platform and follow best practices for security to protect your investment.

3. Can Bitcoin Be Regulated?

While Bitcoin’s decentralized nature makes it challenging to regulate fully, governments can impose rules on exchanges, businesses, and users within their jurisdiction. Staying informed about these regulations is key to navigating the Bitcoin ecosystem safely.

Conclusion

In conclusion, Bitcoin offers incredible opportunities for individuals and businesses looking to explore the world of digital currencies. By understanding its features, benefits, and risks, you can make informed decisions about incorporating Bitcoin into your financial strategy. Whether you’re buying, mining, or simply learning more about it, Bitcoin has something for everyone.

We’d love to hear your thoughts and experiences with Bitcoin in the comments below. And while you’re here, feel free to explore other articles on our site for even more insights into the exciting world of cryptocurrencies. Together, let’s shape the future of finance!