Inflation plays a crucial role in shaping the financial well-being of individuals, businesses, and entire economies. With rising prices becoming a major concern worldwide, understanding inflation has never been more important. From affecting your wallet to influencing global markets, let's dive into what's happening and how you can prepare for it.

Inflation isn’t just a number on a spreadsheet—it’s a real-world issue that impacts everyday life. Whether you’re filling up your gas tank, buying groceries, or planning for retirement, inflation affects how far your money goes. In this article, we’ll break down the latest trends, explore the causes, and discuss practical ways to manage its effects. Think of it as your personal roadmap to staying financially savvy in uncertain times.

This guide is designed to give you a clear picture of inflation, its implications, and actionable strategies to protect yourself. Whether you're a family looking to stretch your budget or a business owner trying to keep operations running smoothly, this article will arm you with the tools you need to make smarter decisions.

Read also:Kissasian Drama Your Ultimate Destination For Asian Series

Table of Contents

- What is Inflation?

- Latest Inflation Trends

- Causes of Inflation

- Effects of Inflation

- Measuring Inflation

- Central Bank Policies to Combat Inflation

- Global Inflation Outlook

- Strategies for Individuals to Combat Inflation

- Impact of Inflation on Businesses

- Conclusion

What is Inflation?

Inflation is simply the gradual increase in the cost of goods and services over time. Picture it like this: if a loaf of bread costs $2 today and $2.10 next year, that’s inflation in action. It’s measured as an annual percentage increase, and when prices go up, your money doesn’t stretch as far. Economists use terms like "demand-pull" and "cost-push" to describe how inflation happens.

Demand-pull inflation occurs when there’s more demand for something than supply can meet, driving prices higher. For example, if everyone suddenly wants electric cars but factories can't produce enough, prices will rise. Cost-push inflation happens when the cost of making things goes up—think higher wages or pricier raw materials. Both scenarios mean you’ll pay more for the same stuff.

Key Characteristics of Inflation

- Inflation quietly chips away at your purchasing power, meaning your money buys less over time.

- It impacts different parts of the economy differently—some industries might thrive while others struggle.

- If left unchecked, inflation can throw economies into chaos, leading to uncertainty and instability.

Latest Inflation Trends

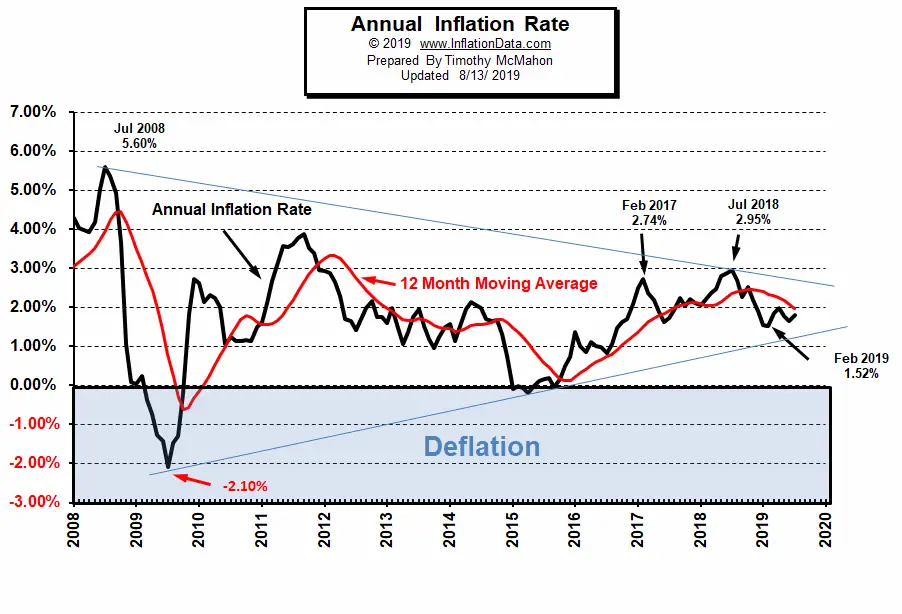

Right now, the world is seeing a surge in inflation. According to the International Monetary Fund (IMF), many countries are grappling with rising prices due to a mix of factors, including supply chain snarls, skyrocketing energy costs, and economies bouncing back from the pandemic. Take the U.S., for example—it hit an inflation rate of 8.5% in 2022, the highest in forty years. That’s a big deal.

Regional Variations in Inflation

- Richer nations like the U.S. and Europe are seeing inflation rates hover around 7% or higher.

- Emerging markets are getting hit even harder, with some countries dealing with inflation rates over 15%.

- Countries that rely heavily on imported energy are especially vulnerable as oil and gas prices soar.

Causes of Inflation

So, what’s behind all this? There are several forces at play here. Central banks control much of the money supply, and when they pump too much cash into the system, inflation can take off. Other factors include broken supply chains, geopolitical drama, and natural disasters that disrupt global trade. Let’s break it down further.

Key Drivers of Inflation

- Monetary Expansion: When central banks print too much money, it floods the market and drives prices up.

- Supply Chain Disruptions: Shortages of critical materials and labor shortages push costs higher, which gets passed onto consumers.

- Geopolitical Tensions: Conflicts and sanctions can wreak havoc on global trade, especially when it comes to energy prices.

Effects of Inflation

The ripple effects of inflation touch everyone. For regular folks, it means your savings lose value and your cost of living goes up. Businesses face higher production costs, which can squeeze profit margins. And governments may need to tweak their budgets and policies to keep things stable. Here’s how it plays out across different groups.

Impact on Different Sectors

- Households: With higher living costs, people have less money left over for fun or savings.

- Businesses: Rising input costs can make it harder to compete, especially for small businesses.

- Governments: Inflation can strain public spending and complicate debt management.

Measuring Inflation

Economists use a few key tools to track inflation. The Consumer Price Index (CPI) measures how much prices change for the stuff people buy regularly, like food and housing. Meanwhile, the Producer Price Index (PPI) looks at what producers are charging for their goods. These numbers help policymakers decide what actions to take.

Read also:Violet Affleck The Rising Star Shaping Her Own Destiny

Key Indicators of Inflation

- Consumer Price Index (CPI): Tracks changes in prices for household items.

- Producer Price Index (PPI): Monitors changes in producer prices.

- GDP Deflator: Provides a broader view of inflation by comparing nominal GDP to real GDP.

Central Bank Policies to Combat Inflation

Central banks are pulling out all the stops to bring inflation under control. They’re raising interest rates, scaling back programs that inject money into the economy, and tightening monetary policy. The Federal Reserve in the U.S., for instance, hiked interest rates multiple times in 2022 to cool down inflation. The European Central Bank (ECB) did something similar to stabilize the eurozone.

Monetary Policy Tools

- Interest Rate Adjustments: Higher rates make borrowing more expensive, slowing down spending.

- Quantitative Tightening: Reducing the money supply to curb inflation.

- Forward Guidance: Communicating future policy moves to influence market expectations.

Global Inflation Outlook

Looking ahead, the inflation picture is still a bit murky. While central banks are working hard to rein it in, outside factors like geopolitical conflicts and climate change could keep prices volatile. The IMF expects inflation to stay high in the short term but hopes it’ll settle down if the right steps are taken.

Key Predictions

- Inflation rates might stabilize by 2024, assuming things go according to plan.

- Emerging markets may struggle with prolonged inflationary pressures.

- Central banks will likely keep inflation control as their top priority.

Strategies for Individuals to Combat Inflation

There’s no magic bullet for beating inflation, but there are steps you can take to shield your finances. Diversifying your investments, finding new ways to earn income, and cutting back on non-essential spending can all help. Building an emergency fund and putting money into assets that grow in value, like real estate or stocks, can also provide a buffer.

Practical Tips

- Diversify Your Investment Portfolio: Spread your money across different asset classes to reduce risk.

- Invest in Inflation-Protected Securities: These investments are designed to keep pace with rising prices.

- Create a Budget and Stick to It: Knowing where your money goes can help you cut unnecessary expenses.

Impact of Inflation on Businesses

Businesses face unique challenges during periods of high inflation. With costs climbing and consumer spending potentially slowing, companies need to get creative. Improving efficiency, adjusting prices, and exploring new markets can help them stay competitive in tough times.

Adaptation Strategies

- Streamline Operations: Find ways to cut costs without sacrificing quality.

- Adjust Pricing: Pass along higher costs to customers carefully to avoid losing business.

- Explore Alternative Markets: Look for new opportunities to grow and diversify revenue streams.

Conclusion

The current inflation trends underscore just how important it is to understand and address the issue. By keeping an eye on key indicators, supporting effective policies, and taking proactive steps, individuals and businesses can better weather the storm of rising prices. Stay informed, adapt to changing conditions, and take action to safeguard your financial future.

We’d love to hear your thoughts and experiences in the comments below. And don’t forget to check out other articles on our site for more insights into economic trends and smart financial strategies. Together, we can build a stronger, more resilient community in the face of inflationary pressures.